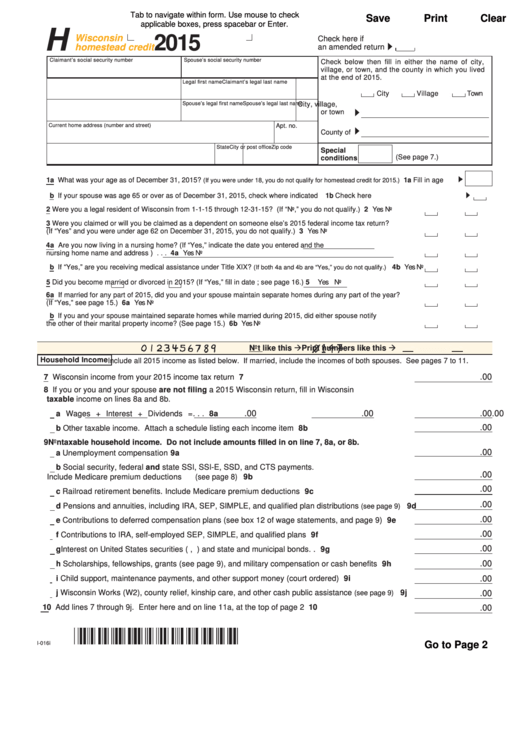

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or Enter.

H

Wisconsin

2015

Check here if

homestead credit

an amended return

Claimant’s social security number

Spouse’s social security number

Check below then fill in either the name of city,

village, or town, and the county in which you lived

at the end of 2015.

Claimant’s legal last name

Legal first name

M.I.

City

Village

Town

Spouse’s legal last name

Spouse’s legal first name

M.I.

City, village,

or town

Current home address (number and street)

Apt. no.

County of

City or post office

State

Zip code

Special

(See page 7.)

conditions

1a What was your age as of December 31, 2015?

1a Fill in age

(If you were under 18, you do not qualify for homestead credit for 2015.)

b If your spouse was age 65 or over as of December 31, 2015, check where indicated . . . . . . . . . . . . . . . . . . . . .

1b Check here

2

Were you a legal resident of Wisconsin from 1-1-15 through 12-31-15? (If “No,” you do not qualify.) . . . . . . . . . . 2

Yes

No

3

Were you claimed or will you be claimed as a dependent on someone else’s 2015 federal income tax return?

(If “Yes” and you were under age 62 on December 31, 2015, you do not qualify.) . . . . . . . . . . . . . . . . . . . . . . . 3

Yes

No

4a Are you now living in a nursing home? (If “Yes,” indicate the date you entered

and the

nursing home name and address

) . . . 4a

Yes

No

b If “Yes,” are you receiving medical assistance under Title XIX?

. . . . 4b

Yes

No

(If both 4a and 4b are “Yes,” you do not qualify.)

5

Did you become

married or

divorced in 2015? (If “Yes,” fill in date

; see page 16.) . . . . 5

Yes

No

6a If married for any part of 2015, did you and your spouse maintain separate homes during any part of the year?

(If “Yes,” see page 15.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

Yes

No

b If you and your spouse maintained separate homes while married during 2015, did either spouse notify

the other of their marital property income? (See page 15.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

Yes

No

Print numbers like this

Not like this

NO COMMAS; NO CENTS

Household Income

Include all 2015 income as listed below. If married, include the incomes of both spouses. See pages 7 to 11.

.00

7

Wisconsin income from your 2015 income tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

If you or you and your spouse are not filing a 2015 Wisconsin return, fill in Wisconsin

taxable income on lines 8a and 8b.

.00

.00

.00

.00

a Wages

+ Interest

+ Dividends

= . . . 8a

.00

b Other taxable income. Attach a schedule listing each income item . . . . . . . . . . . . . . . . . . . . . . . . 8b

9

Nontaxable household income. Do not include amounts filled in on line 7, 8a, or 8b.

.00

a Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a

b Social security, federal and state SSI, SSI-E, SSD, and CTS payments.

.00

Include Medicare premium deductions (see page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9b

.00

c Railroad retirement benefits. Include Medicare premium deductions . . . . . . . . . . . . . . . . . . . . . . . 9c

.00

d Pensions and annuities, including IRA, SEP, SIMPLE, and qualified plan distributions

9d

(see page 9)

.00

e Contributions to deferred compensation plans (see box 12 of wage statements, and page 9) . . . . 9e

.00

f Contributions to IRA, self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . 9f

.00

g Interest on United States securities (e.g., U.S. Savings Bonds) and state and municipal bonds . . 9g

.00

h Scholarships, fellowships, grants (see page 9), and military compensation or cash benefits . . . . 9h

.00

i Child support, maintenance payments, and other support money (court ordered) . . . . . . . . . . . . . 9i

j Wisconsin Works (W2), county relief, kinship care, and other cash public assistance

9j

(see page 9)

.00

10

Add lines 7 through 9j. Enter here and on line 11a, at the top of page 2 . . . . . . . . . . . . . . . . . . . 10

.00

I-016i

Go to Page 2

1

1 2

2 3

3