Instructions For Arizona Form 310 - Credit For Solar Energy Devices - 2014

ADVERTISEMENT

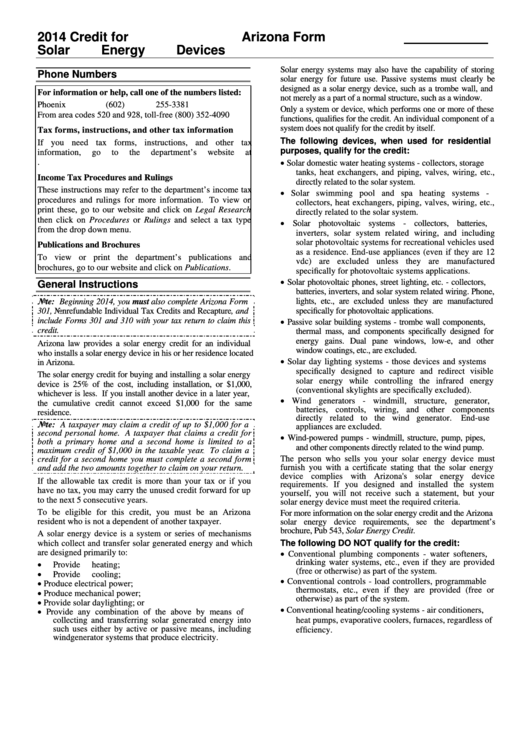

2014 Credit for

Arizona Form

Solar Energy Devices

310

Solar energy systems may also have the capability of storing

Phone Numbers

solar energy for future use. Passive systems must clearly be

designed as a solar energy device, such as a trombe wall, and

For information or help, call one of the numbers listed:

not merely as a part of a normal structure, such as a window.

Phoenix

(602) 255-3381

Only a system or device, which performs one or more of these

From area codes 520 and 928, toll-free

(800) 352-4090

functions, qualifies for the credit. An individual component of a

system does not qualify for the credit by itself.

Tax forms, instructions, and other tax information

The following devices, when used for residential

If you need tax forms, instructions, and other tax

purposes, qualify for the credit:

information,

go

to

the

department’s

website

at

Solar domestic water heating systems - collectors, storage

tanks, heat exchangers, and piping, valves, wiring, etc.,

Income Tax Procedures and Rulings

directly related to the solar system.

These instructions may refer to the department’s income tax

Solar swimming pool and spa heating systems -

procedures and rulings for more information. To view or

collectors, heat exchangers, piping, valves, wiring, etc.,

print these, go to our website and click on Legal Research

directly related to the solar system.

then click on Procedures or Rulings and select a tax type

Solar photovoltaic systems - collectors, batteries,

from the drop down menu.

inverters, solar system related wiring, and including

solar photovoltaic systems for recreational vehicles used

Publications and Brochures

as a residence. End-use appliances (even if they are 12

To view or print the department’s publications and

vdc) are excluded unless they are manufactured

brochures, go to our website and click on Publications.

specifically for photovoltaic systems applications.

Solar photovoltaic phones, street lighting, etc. - collectors,

General Instructions

batteries, inverters, and solar system related wiring. Phone,

lights, etc., are excluded unless they are manufactured

Note: Beginning 2014, you must also complete Arizona Form

specifically for photovoltaic applications.

301, Nonrefundable Individual Tax Credits and Recapture, and

include Forms 301 and 310 with your tax return to claim this

Passive solar building systems - trombe wall components,

credit.

thermal mass, and components specifically designed for

energy gains. Dual pane windows, low-e, and other

Arizona law provides a solar energy credit for an individual

window coatings, etc., are excluded.

who installs a solar energy device in his or her residence located

Solar day lighting systems - those devices and systems

in Arizona.

specifically designed to capture and redirect visible

The solar energy credit for buying and installing a solar energy

solar energy while controlling the infrared energy

device is 25% of the cost, including installation, or $1,000,

(conventional skylights are specifically excluded).

whichever is less. If you install another device in a later year,

Wind generators - windmill, structure, generator,

the cumulative credit cannot exceed $1,000 for the same

batteries, controls, wiring, and other components

residence.

directly related to the wind generator.

End-use

Note: A taxpayer may claim a credit of up to $1,000 for a

appliances are excluded.

second personal home. A taxpayer that claims a credit for

Wind-powered pumps - windmill, structure, pump, pipes,

both a primary home and a second home is limited to a

and other components directly related to the wind pump.

maximum credit of $1,000 in the taxable year

. To claim a

.

The person who sells you your solar energy device must

credit for a second home you must complete a second form

furnish you with a certificate stating that the solar energy

and add the two amounts together to claim on your return.

device complies with Arizona's solar energy device

If the allowable tax credit is more than your tax or if you

requirements. If you designed and installed the system

have no tax, you may carry the unused credit forward for up

yourself, you will not receive such a statement, but your

to the next 5 consecutive years.

solar energy device must meet the required criteria.

To be eligible for this credit, you must be an Arizona

For more information on the solar energy credit and the Arizona

resident who is not a dependent of another taxpayer.

solar energy device requirements, see the department’s

brochure, Pub 543, Solar Energy Credit.

A solar energy device is a system or series of mechanisms

which collect and transfer solar generated energy and which

The following DO NOT qualify for the credit:

are designed primarily to:

Conventional plumbing components - water softeners,

drinking water systems, etc., even if they are provided

Provide heating;

(free or otherwise) as part of the system.

Provide cooling;

Conventional controls - load controllers, programmable

Produce electrical power;

thermostats, etc., even if they are provided (free or

Produce mechanical power;

otherwise) as part of the system.

Provide solar daylighting; or

Conventional heating/cooling systems - air conditioners,

Provide any combination of the above by means of

heat pumps, evaporative coolers, furnaces, regardless of

collecting and transferring solar generated energy into

such uses either by active or passive means, including

efficiency.

wind generator systems that produce electricity.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2