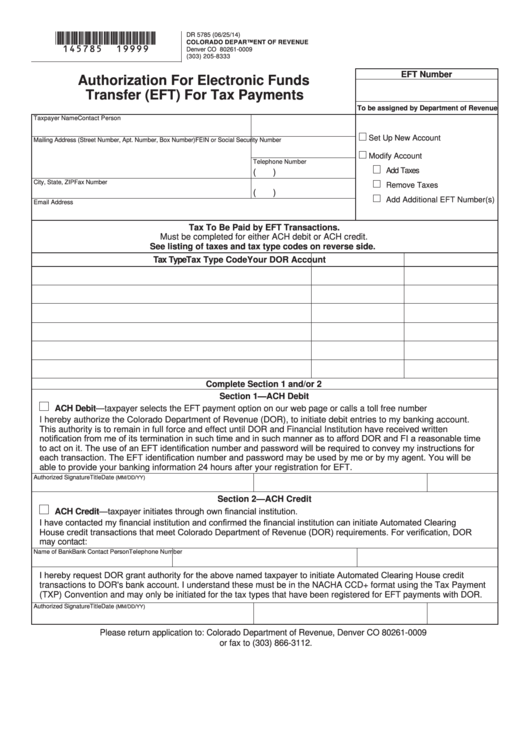

*145785==19999*

DR 5785 (06/25/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009

(303) 205-8333

EFT Number

Authorization For Electronic Funds

Transfer (EFT) For Tax Payments

To be assigned by Department of Revenue

Taxpayer Name

Contact Person

Set Up New Account

Mailing Address (Street Number, Apt. Number, Box Number)

FEIN or Social Security Number

Modify Account

Telephone Number

Add Taxes

(

)

City, State, ZIP

Fax Number

Remove Taxes

(

)

Add Additional EFT Number(s)

Email Address

Tax To Be Paid by EFT Transactions.

Must be completed for either ACH debit or ACH credit.

See listing of taxes and tax type codes on reverse side.

Tax Type

Tax Type Code

Your DOR Account

Complete Section 1 and/or 2

Section 1—ACH Debit

ACH Debit—taxpayer selects the EFT payment option on our web page or calls a toll free number

I hereby authorize the Colorado Department of Revenue (DOR), to initiate debit entries to my banking account.

This authority is to remain in full force and effect until DOR and Financial Institution have received written

notification from me of its termination in such time and in such manner as to afford DOR and FI a reasonable time

to act on it. The use of an EFT identification number and password will be required to convey my instructions for

each transaction. The EFT identification number and password may be used by me or by my agent. You will be

able to provide your banking information 24 hours after your registration for EFT.

(MM/DD/YY)

Authorized Signature

Title

Date

Section 2—ACH Credit

ACH Credit—taxpayer initiates through own financial institution.

I have contacted my financial institution and confirmed the financial institution can initiate Automated Clearing

House credit transactions that meet Colorado Department of Revenue (DOR) requirements. For verification, DOR

may contact:

Name of Bank

Bank Contact Person

Telephone Number

I hereby request DOR grant authority for the above named taxpayer to initiate Automated Clearing House credit

transactions to DOR's bank account. I understand these must be in the NACHA CCD+ format using the Tax Payment

(TXP) Convention and may only be initiated for the tax types that have been registered for EFT payments with DOR.

(MM/DD/YY)

Authorized Signature

Title

Date

Please return application to: Colorado Department of Revenue, Denver CO 80261-0009

or fax to (303) 866-3112.

1

1 2

2