Instructions For Arizona Form 312 - Agricultural Water Conservation System Credit - 2014

ADVERTISEMENT

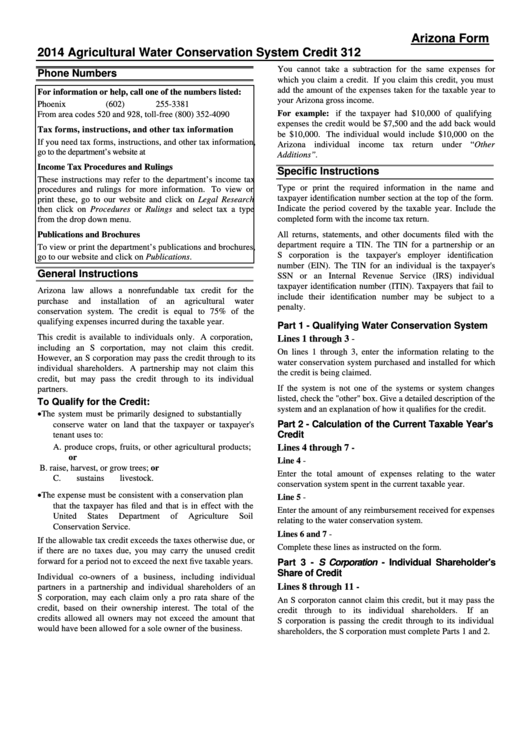

Arizona Form

2014 Agricultural Water Conservation System Credit

312

You cannot take a subtraction for the same expenses for

Phone Numbers

which you claim a credit. If you claim this credit, you must

add the amount of the expenses taken for the taxable year to

For information or help, call one of the numbers listed:

your Arizona gross income.

Phoenix

(602) 255-3381

For example: if the taxpayer had $10,000 of qualifying

From area codes 520 and 928, toll-free

(800) 352-4090

expenses the credit would be $7,500 and the add back would

Tax forms, instructions, and other tax information

be $10,000. The individual would include $10,000 on the

If you need tax forms, instructions, and other tax information,

Arizona individual income tax return under “Other

go to the department’s website at

Additions”.

Income Tax Procedures and Rulings

Specific Instructions

These instructions may refer to the department’s income tax

Type or print the required information in the name and

procedures and rulings for more information. To view or

taxpayer identification number section at the top of the form.

print these, go to our website and click on Legal Research

Indicate the period covered by the taxable year. Include the

then click on Procedures or Rulings and select tax a type

completed form with the income tax return.

from the drop down menu.

All returns, statements, and other documents filed with the

Publications and Brochures

department require a TIN. The TIN for a partnership or an

To view or print the department’s publications and brochures,

S corporation is the taxpayer's employer identification

go to our website and click on Publications.

number (EIN). The TIN for an individual is the taxpayer's

General Instructions

SSN or an Internal Revenue Service (IRS) individual

taxpayer identification number (ITIN). Taxpayers that fail to

Arizona law allows a nonrefundable tax credit for the

include their identification number may be subject to a

purchase

and

installation

of

an

agricultural

water

penalty.

conservation system. The credit is equal to 75% of the

qualifying expenses incurred during the taxable year.

Part 1 - Qualifying Water Conservation System

This credit is available to individuals only. A corporation,

Lines 1 through 3 -

including an S corportation, may not claim this credit.

On lines 1 through 3, enter the information relating to the

However, an S corporation may pass the credit through to its

water conservation system purchased and installed for which

individual shareholders. A partnership may not claim this

the credit is being claimed.

credit, but may pass the credit through to its individual

If the system is not one of the systems or system changes

partners.

listed, check the "other" box. Give a detailed description of the

To Qualify for the Credit:

system and an explanation of how it qualifies for the credit.

The system must be primarily designed to substantially

Part 2 - Calculation of the Current Taxable Year's

conserve water on land that the taxpayer or taxpayer's

Credit

tenant uses to:

A. produce crops, fruits, or other agricultural products;

Lines 4 through 7 -

or

Line 4 -

B. raise, harvest, or grow trees; or

Enter the total amount of expenses relating to the water

C. sustains livestock.

conservation system spent in the current taxable year.

The expense must be consistent with a conservation plan

Line 5 -

that the taxpayer has filed and that is in effect with the

Enter the amount of any reimbursement received for expenses

United

States

Department

of

Agriculture

Soil

relating to the water conservation system.

Conservation Service.

Lines 6 and 7 -

If the allowable tax credit exceeds the taxes otherwise due, or

Complete these lines as instructed on the form.

if there are no taxes due, you may carry the unused credit

forward for a period not to exceed the next five taxable years.

Part 3 - S Corporation - Individual Shareholder's

Share of Credit

Individual co-owners of a business, including individual

Lines 8 through 11 -

partners in a partnership and individual shareholders of an

S corporation, may each claim only a pro rata share of the

An S corporaton cannot claim this credit, but it may pass the

credit, based on their ownership interest. The total of the

credit through to its individual shareholders.

If an

credits allowed all owners may not exceed the amount that

S corporation is passing the credit through to its individual

would have been allowed for a sole owner of the business.

shareholders, the S corporation must complete Parts 1 and 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2