Tab within form to navigate. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

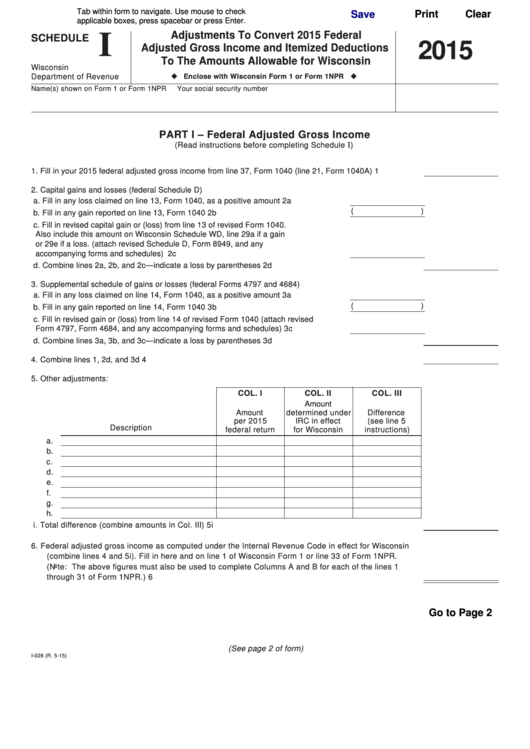

Adjustments To Convert 2015 Federal

I

SCHEDULE

2015

Adjusted Gross Income and Itemized Deductions

To The Amounts Allowable for Wisconsin

Wisconsin

u Enclose with Wisconsin Form 1 or Form 1NPR u

Department of Revenue

Name(s) shown on Form 1 or Form 1NPR

Your social security number

PART I – Federal Adjusted Gross Income

I

(Read instructions before completing Schedule

)

1.

Fill in your 2015 federal adjusted gross income from line 37, Form 1040 (line 21, Form 1040A) . . . . . . . 1

2.

Capital gains and losses (federal Schedule D)

a.

Fill in any loss claimed on line 13, Form 1040, as a positive amount . . . . . . . 2a

(

)

b.

Fill in any gain reported on line 13, Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . 2b

c.

Fill in revised capital gain or (loss) from line 13 of revised Form 1040.

Also include this amount on Wisconsin Schedule WD, line 29a if a gain

or 29e if a loss. (attach revised Schedule D, Form 8949, and any

accompanying forms and schedules) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

d.

Combine lines 2a, 2b, and 2c—indicate a loss by parentheses . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3.

Supplemental schedule of gains or losses (federal Forms 4797 and 4684)

a.

Fill in any loss claimed on line 14, Form 1040, as a positive amount . . . . . . . 3a

(

)

b.

Fill in any gain reported on line 14, Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . 3b

c.

Fill in revised gain or (loss) from line 14 of revised Form 1040 (attach revised

Form 4797, Form 4684, and any accompanying forms and schedules) . . . . . . 3c

d.

Combine lines 3a, 3b, and 3c—indicate a loss by parentheses . . . . . . . . . . . . . . . . . . . . . . . . . . . 3d

4.

Combine lines 1, 2d, and 3d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5.

Other adjustments:

COL. I

COL. II

COL. III

Amount

Amount

determined under

Difference

per 2015

IRC in effect

(see line 5

Description

federal return

for Wisconsin

instructions)

a.

b.

c.

d.

e.

f.

g.

h.

i.

Total difference (combine amounts in Col. III) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5i

6.

Federal adjusted gross income as computed under the Internal Revenue Code in effect for Wisconsin

(combine lines 4 and 5i). Fill in here and on line 1 of Wisconsin Form 1 or line 33 of Form 1NPR.

(Note: The above figures must also be used to complete Columns A and B for each of the lines 1

through 31 of Form 1NPR.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

Go to Page 2

(See page 2 of form)

I-028 (R. 5-15)

1

1 2

2