Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

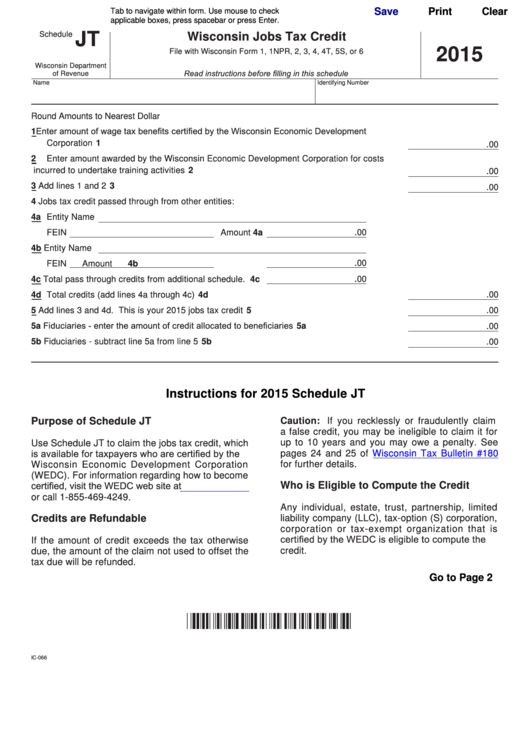

Schedule

JT

Wisconsin Jobs Tax Credit

2015

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Round Amounts to Nearest Dollar

Enter amount of wage tax benefits certified by the Wisconsin Economic Development

1

Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.

00

2

Enter amount awarded by the Wisconsin Economic Development Corporation for costs

incurred to undertake training activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

00

3

Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

00

4

Jobs tax credit passed through from other entities:

4a Entity Name

.

FEIN

Amount 4a

00

4b Entity Name

.

00

FEIN

Amount 4b

.

00

4c Total pass through credits from additional schedule . 4c

.

00

4d Total credits (add lines 4a through 4c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d

.

5

Add lines 3 and 4d . This is your 2015 jobs tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

5a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . 5a

.

00

.

5b Fiduciaries - subtract line 5a from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

00

Instructions for 2015 Schedule JT

Caution: If you recklessly or fraudulently claim

Purpose of Schedule JT

a false credit, you may be ineligible to claim it for

up to 10 years and you may owe a penalty . See

Use Schedule JT to claim the jobs tax credit, which

is available for taxpayers who are certified by the

pages 24 and 25 of

Wisconsin Tax Bulletin #180

for further details .

Wisconsin Economic Development Corporation

(WEDC) . For information regarding how to become

certified, visit the WEDC web site at

Who is Eligible to Compute the Credit

inwisconsin .com

or call 1-855-469-4249 .

Any individual, estate, trust, partnership, limited

Credits are Refundable

liability company (LLC), tax-option (S) corporation,

corporation or tax-exempt organization that is

certified by the WEDC is eligible to compute the

If the amount of credit exceeds the tax otherwise

credit .

due, the amount of the claim not used to offset the

tax due will be refunded .

Go to Page 2

IC-066

1

1 2

2