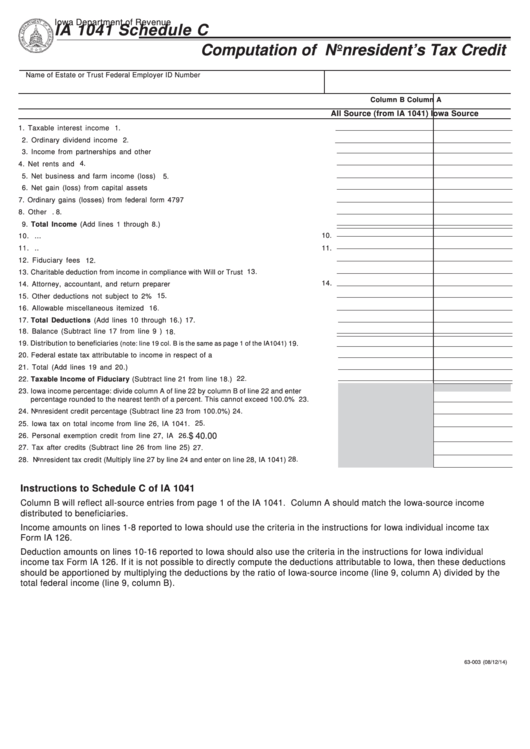

Schedule C (Form Ia 1041) - Computation Of Nonresident'S Tax Credit

ADVERTISEMENT

Iowa Department of Revenue

IA 1041 Schedule C

Computation of Nonresident’s Tax Credit

Name of Estate or Trust

Federal Employer ID Number

Column B

Column A

All Source (from IA 1041)

Iowa Source

1. Taxable interest income ................................................................................................ 1.

2. Ordinary dividend income .............................................................................................. 2.

3. Income from partnerships and other fiduciaries................................................................. 3.

4. Net rents and royalties................................................................................................... 4.

5. Net business and farm income (loss) ............................................................................. 5.

6. Net gain (loss) from capital assets ................................................................................ 6.

7. Ordinary gains (losses) from federal form 4797 ................................................................ 7.

8. Other income................................................................................................................ 8.

9. Total Income (Add lines 1 through 8.) ............................................................................ 9.

10. Interest...................................................................................................................... 10.

11. Taxes........................................................................................................................ 11.

12. Fiduciary fees ........................................................................................................... 12.

13. Charitable deduction from income in compliance with Will or Trust Instrument................... 13.

14. Attorney, accountant, and return preparer fees............................................................... 14.

15. Other deductions not subject to 2% floor....................................................................... 15.

16. Allowable miscellaneous itemized deductions................................................................ 16.

17. Total Deductions (Add lines 10 through 16.)................................................................. 17.

18. Balance (Subtract line 17 from line 9 ).......................................................................... 18.

19. Distribution to beneficiaries

........... 19.

(note: line 19 col. B is the same as page 1 of the IA1041)....

20. Federal estate tax attributable to income in respect of a decedent.................................... 20.

21. Total (Add lines 19 and 20.)......................................................................................... 21.

22. Taxable Income of Fiduciary (Subtract line 21 from line 18.) ........................................ 22.

23. Iowa income percentage: divide column A of line 22 by column B of line 22 and enter

percentage rounded to the nearest tenth of a percent. This cannot exceed 100.0% ......... 23.

24. Nonresident credit percentage (Subtract line 23 from 100.0%)......................................... 24.

25. Iowa tax on total income from line 26, IA 1041. ............................................................ 25.

26. Personal exemption credit from line 27, IA 1041............................................................ 26.

$ 40.00

27. Tax after credits (Subtract line 26 from line 25)............................................................. 27.

28. Nonresident tax credit (Multiply line 27 by line 24 and enter on line 28, IA 1041).............. 28.

Instructions to Schedule C of IA 1041

Column B will reflect all-source entries from page 1 of the IA 1041. Column A should match the Iowa-source income

distributed to beneficiaries.

Income amounts on lines 1-8 reported to Iowa should use the criteria in the instructions for Iowa individual income tax

Form IA 126.

Deduction amounts on lines 10-16 reported to Iowa should also use the criteria in the instructions for Iowa individual

income tax Form IA 126. If it is not possible to directly compute the deductions attributable to Iowa, then these deductions

should be apportioned by multiplying the deductions by the ratio of Iowa-source income (line 9, column A) divided by the

total federal income (line 9, column B).

63-003

(08/12/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1