Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

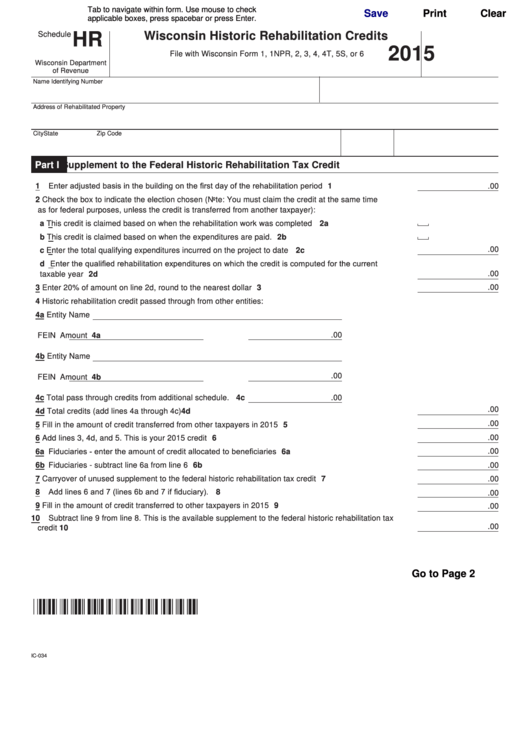

Schedule

HR

Wisconsin Historic Rehabilitation Credits

2015

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

Wisconsin Department

of Revenue

Name

Identifying Number

Address of Rehabilitated Property

Zip Code

City

State

Part I

Supplement to the Federal Historic Rehabilitation Tax Credit

1 Enter adjusted basis in the building on the first day of the rehabilitation period . . . . . . . . . . . . . . . . . 1

.00

2

Check the box to indicate the election chosen (Note: You must claim the credit at the same time

as for federal purposes, unless the credit is transferred from another taxpayer):

a This credit is claimed based on when the rehabilitation work was completed . . . . . . . . . . . . . . . . 2a

b This credit is claimed based on when the expenditures are paid . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

.00

c Enter the total qualifying expenditures incurred on the project to date . . . . . . . . . . . . . . . . . . . . . . 2c

d Enter the qualified rehabilitation expenditures on which the credit is computed for the current

.00

taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

.00

3

Enter 20% of amount on line 2d, round to the nearest dollar . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Historic rehabilitation credit passed through from other entities:

4a Entity Name

.00

FEIN

Amount 4a

4b Entity Name

.00

FEIN

Amount 4b

4c Total pass through credits from additional schedule . 4c

.00

.00

4d Total credits (add lines 4a through 4c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4d

.00

5

Fill in the amount of credit transferred from other taxpayers in 2015 . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

6

Add lines 3, 4d, and 5 . This is your 2015 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

6a

6b Fiduciaries - subtract line 6a from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

.00

7

Carryover of unused supplement to the federal historic rehabilitation tax credit . . . . . . . . . . . . . . . . .

7

.00

8 Add lines 6 and 7 (lines 6b and 7 if fiduciary). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

9

Fill in the amount of credit transferred to other taxpayers in 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.00

10

Subtract line 9 from line 8 . This is the available supplement to the federal historic rehabilitation tax

.00

credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Go to Page 2

IC-034

1

1 2

2