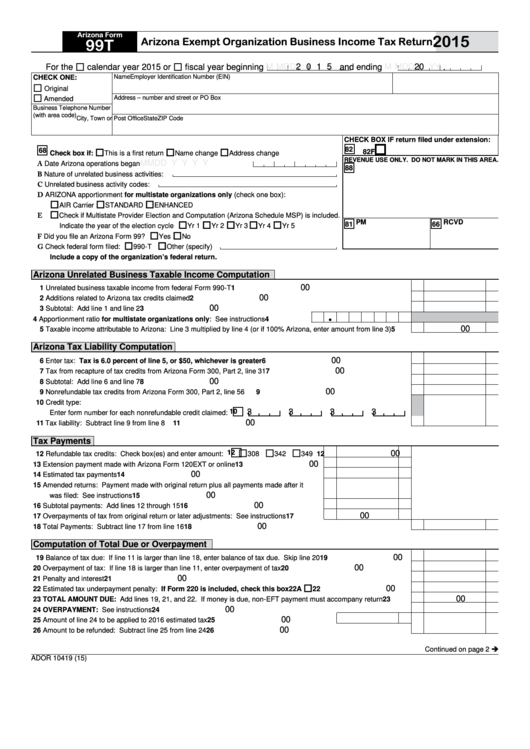

Arizona Form

2015

Arizona Exempt Organization Business Income Tax Return

99T

For the

calendar year 2015 or

fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D

2 0

Y Y

.

Name

Employer Identification Number (EIN)

CHECK ONE:

Original

Address – number and street or PO Box

Amended

Business Telephone Number

(with area code)

City, Town or Post Office

State

ZIP Code

CHECK BOX IF return filed under extension:

82

68 Check box if:

This is a first return

Name change

Address change

82F

M M D D Y Y Y Y

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

A

Date Arizona operations began ..................................................

88

B

Nature of unrelated business activities:

C Unrelated business activity codes:

D ARIZONA apportionment for multistate organizations only (check one box):

A IR Carrier

STANDARD

ENHANCED

E

Check if Multistate Provider Election and Computation (Arizona Schedule MSP) is included.

81 PM

66 RCVD

Indicate the year of the election cycle .................

Yr 1

Yr 2

Yr 3

Yr 4

Yr 5

F

Did you file an Arizona Form 99? ....................................................................

Yes

No

G Check federal form filed:

990-T

Other (specify)

Include a copy of the organization’s federal return.

Arizona Unrelated Business Taxable Income Computation

00

1 Unrelated business taxable income from federal Form 990-T .........................................................................................

1

00

2 Additions related to Arizona tax credits claimed ..............................................................................................................

2

00

3 Subtotal: Add line 1 and line 2 ........................................................................................................................................

3

4 Apportionment ratio for multistate organizations only: See instructions .........

•

4

00

5 Taxable income attributable to Arizona: Line 3 multiplied by line 4 (or if 100% Arizona, enter amount from line 3) .......

5

Arizona Tax Liability Computation

00

6 Enter tax: Tax is 6.0 percent of line 5, or $50, whichever is greater .........................................................................

6

00

7 Tax from recapture of tax credits from Arizona Form 300, Part 2, line 31 ........................................................................

7

00

8 Subtotal: Add line 6 and line 7 ........................................................................................................................................

8

00

9 Nonrefundable tax credits from Arizona Form 300, Part 2, line 56 ..................................................................................

9

10 Credit type:

3

3

3

3

Enter form number for each nonrefundable credit claimed: 10

00

11 Tax liability: Subtract line 9 from line 8 ............................................................................................................................

11

Tax Payments

00

12 Refundable tax credits: Check box(es) and enter amount: 12

308

342

349

12

00

13 Extension payment made with Arizona Form 120EXT or online ........................................

13

00

14 Estimated tax payments ....................................................................................................

14

15 Amended returns: Payment made with original return plus all payments made after it

00

was filed: See instructions ................................................................................................

15

00

16 Subtotal payments: Add lines 12 through 15 ....................................................................

16

00

17 Overpayments of tax from original return or later adjustments: See instructions .............

17

00

18 Total Payments: Subtract line 17 from line 16 ................................................................................................................

18

Computation of Total Due or Overpayment

00

19 Balance of tax due: If line 11 is larger than line 18, enter balance of tax due. Skip line 20 ...........................................

19

00

20 Overpayment of tax: If line 18 is larger than line 11, enter overpayment of tax ..............................................................

20

00

21 Penalty and interest .........................................................................................................................................................

21

00

22 Estimated tax underpayment penalty: If Form 220 is included, check this box .............................................22A

22

00

23 TOTAL AMOUNT DUE: Add lines 19, 21, and 22. If money is due, non-EFT payment must accompany return .........

23

00

24 OVERPAYMENT: See instructions .................................................................................................................................

24

00

25 Amount of line 24 to be applied to 2016 estimated tax ......................................................

25

00

26 Amount to be refunded: Subtract line 25 from line 24 ....................................................................................................

26

Continued on page 2

ADOR 10419 (15)

1

1 2

2