Instructions For Arizona Form 308-I - Credit For Increased Research Activities - Individuals - 2014

ADVERTISEMENT

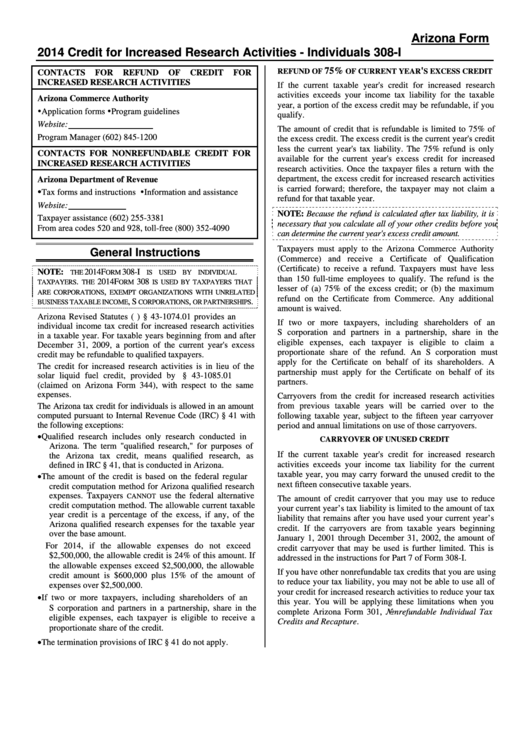

Arizona Form

2014 Credit for Increased Research Activities - Individuals

308-I

75%

'

REFUND OF

OF CURRENT YEAR

S EXCESS CREDIT

CONTACTS

FOR

REFUND

OF

CREDIT

FOR

INCREASED RESEARCH ACTIVITIES

If the current taxable year's credit for increased research

activities exceeds your income tax liability for the taxable

Arizona Commerce Authority

year, a portion of the excess credit may be refundable, if you

Application forms Program guidelines

qualify.

Website:

The amount of credit that is refundable is limited to 75% of

Program Manager

(602) 845-1200

the excess credit. The excess credit is the current year's credit

less the current year's tax liability. The 75% refund is only

CONTACTS FOR NONREFUNDABLE CREDIT FOR

available for the current year's excess credit for increased

INCREASED RESEARCH ACTIVITIES

research activities. Once the taxpayer files a return with the

department, the excess credit for increased research activities

Arizona Department of Revenue

is carried forward; therefore, the taxpayer may not claim a

Tax forms and instructions Information and assistance

refund for that taxable year.

Website:

NOTE: Because the refund is calculated after tax liability, it is

Taxpayer assistance

(602) 255-3381

necessary that you calculate all of your other credits before you

From area codes 520 and 928, toll-free

(800) 352-4090

can determine the current year's excess credit amount.

Taxpayers must apply to the Arizona Commerce Authority

General Instructions

(Commerce) and receive a Certificate of Qualification

(Certificate) to receive a refund. Taxpayers must have less

NOTE:

2014 F

308-I

THE

ORM

IS USED BY INDIVIDUAL

than 150 full-time employees to qualify. The refund is the

.

2014 F

308

TAXPAYERS

THE

ORM

IS USED BY TAXPAYERS THAT

lesser of (a) 75% of the excess credit; or (b) the maximum

,

ARE CORPORATIONS

EXEMPT ORGANIZATIONS WITH UNRELATED

refund on the Certificate from Commerce. Any additional

, S

,

.

BUSINESS TAXABLE INCOME

CORPORATIONS

OR PARTNERSHIPS

amount is waived.

Arizona Revised Statutes (A.R.S.) § 43-1074.01 provides an

If two or more taxpayers, including shareholders of an

individual income tax credit for increased research activities

S corporation and partners in a partnership, share in the

in a taxable year. For taxable years beginning from and after

eligible expenses, each taxpayer is eligible to claim a

December 31, 2009, a portion of the current year's excess

proportionate share of the refund. An S corporation must

credit may be refundable to qualified taxpayers.

apply for the Certificate on behalf of its shareholders. A

The credit for increased research activities is in lieu of the

partnership must apply for the Certificate on behalf of its

solar liquid fuel credit, provided by A.R.S. § 43-1085.01

partners.

(claimed on Arizona Form 344), with respect to the same

expenses.

Carryovers from the credit for increased research activities

from previous taxable years will be carried over to the

The Arizona tax credit for individuals is allowed in an amount

computed pursuant to Internal Revenue Code (IRC) § 41 with

following taxable year, subject to the fifteen year carryover

the following exceptions:

period and annual limitations on use of those carryovers.

Qualified research includes only research conducted in

CARRYOVER OF UNUSED CREDIT

Arizona. The term "qualified research," for purposes of

If the current taxable year's credit for increased research

the Arizona tax credit, means qualified research, as

activities exceeds your income tax liability for the current

defined in IRC § 41, that is conducted in Arizona.

The amount of the credit is based on the federal regular

taxable year, you may carry forward the unused credit to the

next fifteen consecutive taxable years.

credit computation method for Arizona qualified research

expenses. Taxpayers

use the federal alternative

CANNOT

The amount of credit carryover that you may use to reduce

credit computation method. The allowable current taxable

your current year’s tax liability is limited to the amount of tax

year credit is a percentage of the excess, if any, of the

liability that remains after you have used your current year’s

Arizona qualified research expenses for the taxable year

credit. If the carryovers are from taxable years beginning

over the base amount.

January 1, 2001 through December 31, 2002, the amount of

For 2014, if the allowable expenses do not exceed

credit carryover that may be used is further limited. This is

$2,500,000, the allowable credit is 24% of this amount. If

addressed in the instructions for Part 7 of Form 308-I.

the allowable expenses exceed $2,500,000, the allowable

If you have other nonrefundable tax credits that you are using

credit amount is $600,000 plus 15% of the amount of

to reduce your tax liability, you may not be able to use all of

expenses over $2,500,000.

your credit for increased research activities to reduce your tax

If two or more taxpayers, including shareholders of an

this year. You will be applying these limitations when you

S corporation and partners in a partnership, share in the

complete Arizona Form 301, Nonrefundable Individual Tax

eligible expenses, each taxpayer is eligible to receive a

Credits and Recapture.

proportionate share of the credit.

The termination provisions of IRC § 41 do not apply.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5