Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

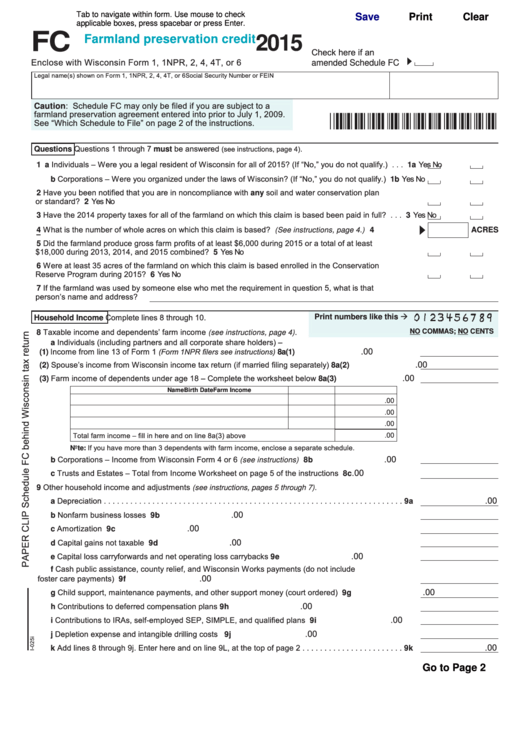

FC

Farmland preservation credit

2015

Check here if an

Enclose with Wisconsin Form 1, 1NPR, 2, 4, 4T, or 6

amended Schedule FC

Legal name(s) shown on Form 1, 1NPR, 2, 4, 4T, or 6

Social Security Number or FEIN

Caution: Schedule FC may only be filed if you are subject to a

farmland preservation agreement entered into prior to July 1, 2009.

See “Which Schedule to File” on page 2 of the instructions.

Questions 1 through 7 must be answered

.

(see instructions, page 4)

Questions

1 a Individuals – Were you a legal resident of Wisconsin for all of 2015? (If “No,” you do not qualify.) . . . 1a

Yes

No

b Corporations – Were you organized under the laws of Wisconsin? (If “No,” you do not qualify.) . . . . 1b

Yes

No

2 Have you been notified that you are in noncompliance with any soil and water conservation plan

or standard? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

3 Have the 2014 property taxes for all of the farmland on which this claim is based been paid in full? . . . 3

Yes

No

4 What is the number of whole acres on which this claim is based? (See instructions, page 4.) . . . . . . . . 4

ACRES

5 Did the farmland produce gross farm profits of at least $6,000 during 2015 or a total of at least

$18,000 during 2013, 2014, and 2015 combined? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Yes

No

6 Were at least 35 acres of the farmland on which this claim is based enrolled in the Conservation

Reserve Program during 2015? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Yes

No

7 If the farmland was used by someone else who met the requirement in question 5, what is that

person’s name and address?

Complete lines 8 through 10.

Print numbers like this

Household Income

8 Taxable income and dependents’ farm income (see instructions, page 4) .

NO COMMAS; NO CENTS

a Individuals (including partners and all corporate share holders) –

.00

(1) Income from line 13 of Form 1 (Form 1NPR filers see instructions) . . . . . . . . . . . . . . . . . . . . . . . 8a(1)

.00

(2) Spouse’s income from Wisconsin income tax return (if married filing separately) . . . . . . . . . . . 8a(2)

.00

(3) Farm income of dependents under age 18 – Complete the worksheet below . . . . . . . . . . . . . . . 8a(3)

Name

Birth Date

Farm Income

.00

.00

.00

.00

Total farm income – fill in here and on line 8a(3) above . . . . . . . . . . . . . . . . . . . . .

Note: If you have more than 3 dependents with farm income, enclose a separate schedule.

.00

b Corporations – Income from Wisconsin Form 4 or 6 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 8b

.00

c Trusts and Estates – Total from Income Worksheet on page 5 of the instructions . . . . . . . . . . . . . . 8c

9 Other household income and adjustments (see instructions, pages 5 through 7) .

.00

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a

.00

b Nonfarm business losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9b

.00

c Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9c

.00

d Capital gains not taxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

.00

e Capital loss carryforwards and net operating loss carrybacks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9e

f Cash public assistance, county relief, and Wisconsin Works payments (do not include

.00

foster care payments) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9f

.00

g Child support, maintenance payments, and other support money (court ordered) . . . . . . . . . . . . . . 9g

.00

h Contributions to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9h

.00

i Contributions to IRAs, self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . 9i

.00

j Depletion expense and intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9j

.00

k Add lines 8 through 9j. Enter here and on line 9L, at the top of page 2 . . . . . . . . . . . . . . . . . . . . . . . 9k

Go to Page 2

1

1 2

2