Form Sc 1120s - 'S' Corporation Income Tax Return

ADVERTISEMENT

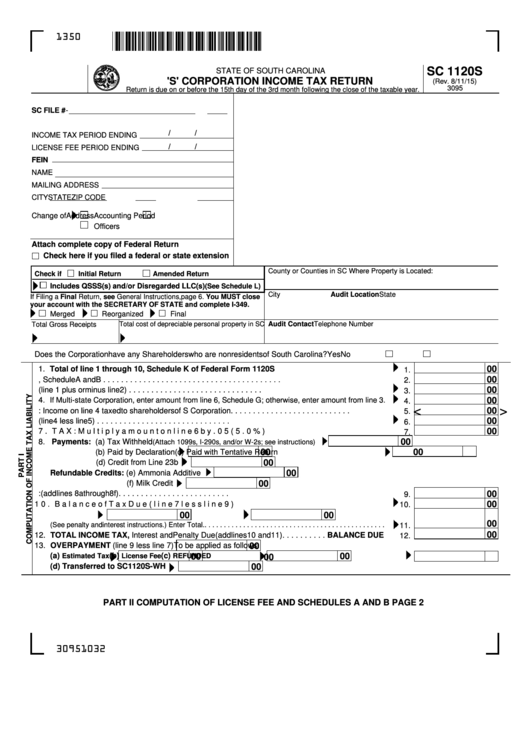

1350

SC 1120S

STATE OF SOUTH CAROLINA

'S' CORPORATION INCOME TAX RETURN

(Rev. 8/11/15)

3095

Return is due on or before the 15th day of the 3rd month following the close of the taxable year.

SC FILE #

-

/

/

INCOME TAX PERIOD ENDING

/

/

LICENSE FEE PERIOD ENDING

FEIN

NAME

MAILING ADDRESS

CITY

STATE

ZIP CODE

Change of

Address

Accounting Period

Officers

Attach complete copy of Federal Return

Check here if you filed a federal or state extension

County or Counties in SC Where Property is Located:

Check if

Initial Return

Amended Return

Includes QSSS(s) and/or Disregarded LLC(s) (See Schedule L)

City

Audit Location

State

If Filing a Final Return, see General Instructions, page 6. You MUST close

your account with the SECRETARY OF STATE and complete I-349.

Merged

Reorganized

Final

Audit Contact

Telephone Number

Total Gross Receipts

Total cost of depreciable personal property in SC

Does the Corporation have any Shareholders who are nonresidents of South Carolina?

Yes

No

00

1. Total of line 1 through 10, Schedule K of Federal Form 1120S . . . . . . . . . . . . . . . . . . . . . . . . .

1.

00

2. Net Adjustment from line 15, Schedule A and B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

00

3. Total Net Income as Reconciled (line 1 plus or minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. If Multi-state Corporation, enter amount from line 6, Schedule G; otherwise, enter amount from line 3.

00

.

4.

<

>

00

5. LESS: Income on line 4 taxed to shareholders of S Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

00

6. South Carolina Net Income subject to tax (line 4 less line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

00

7. TAX: Multiply amount on line 6 by .05 (5.0%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

00

8. Payments: (a) Tax Withheld

(Attach 1099s, I-290s, and/or W-2s; see instructions)

00

00

(b) Paid by Declaration

(c) Paid with Tentative Return

(d) Credit from Line 23b

00

Refundable Credits: (e) Ammonia Additive

00

(f) Milk Credit

00

00

9. Total Payments and Refundable Credits:(add lines 8a through 8f) . . . . . . . . . . . . . . . . . . . . . . . . .

9.

00

10. Balance of Tax Due (line 7 less line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Interest Due

Penalty Due

00

00

00

(See penalty and interest instructions.) Enter Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

00

12. TOTAL INCOME TAX, Interest and Penalty Due (add lines 10 and 11) . . . . . . . . . . BALANCE DUE

12.

13. OVERPAYMENT (line 9 less line 7)

00

To be applied as follows:

(a)

00

(b)

00

(c)

Estimated Tax

License Fee

REFUNDED

00

(d) Transferred to SC1120S-WH

00

PART II COMPUTATION OF LICENSE FEE AND SCHEDULES A AND B PAGE 2

30951032

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7