Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

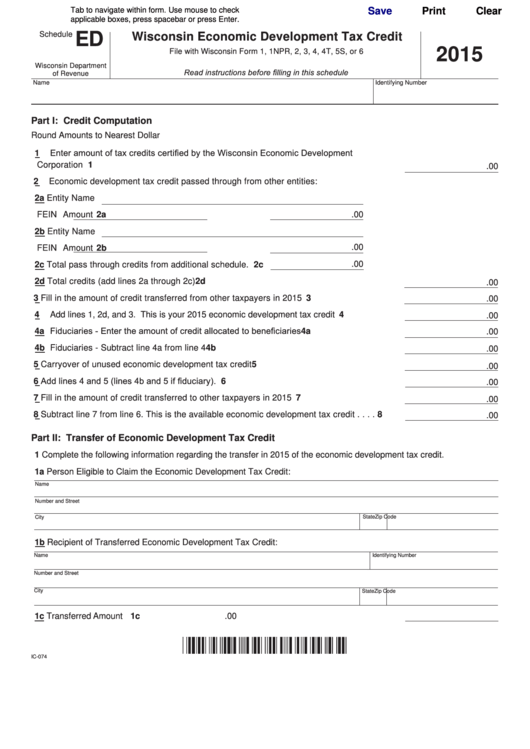

Schedule

ED

Wisconsin Economic Development Tax Credit

2015

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Part I: Credit Computation

Round Amounts to Nearest Dollar

Enter amount of tax credits certified by the Wisconsin Economic Development

1

Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2

Economic development tax credit passed through from other entities:

2a Entity Name

FEIN

Amount 2a

.00

2b Entity Name

.00

FEIN

Amount 2b

.00

2c Total pass through credits from additional schedule. 2c

2d Total credits (add lines 2a through 2c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

.00

3

Fill in the amount of credit transferred from other taxpayers in 2015. . . . . . . . . . . . . . . 3

.00

4

Add lines 1, 2d, and 3. This is your 2015 economic development tax credit . . . . . . . . . 4

.00

4a Fiduciaries - Enter the amount of credit allocated to beneficiaries. . . . . . . . . . . . . . . . . 4a

.00

4b Fiduciaries - Subtract line 4a from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

.00

5

Carryover of unused economic development tax credit . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

Add lines 4 and 5 (lines 4b and 5 if fiduciary). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

6

.00

7

Fill in the amount of credit transferred to other taxpayers in 2015 . . . . . . . . . . . . . . . . . 7

.00

8

Subtract line 7 from line 6. This is the available economic development tax credit . . . . 8

.00

Part II: Transfer of Economic Development Tax Credit

1

Complete the following information regarding the transfer in 2015 of the economic development tax credit.

1a Person Eligible to Claim the Economic Development Tax Credit:

Name

Number and Street

City

State

Zip Code

1b Recipient of Transferred Economic Development Tax Credit:

Name

Identifying Number

Number and Street

City

State

Zip Code

1c Transferred Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

.00

IC-074

1

1