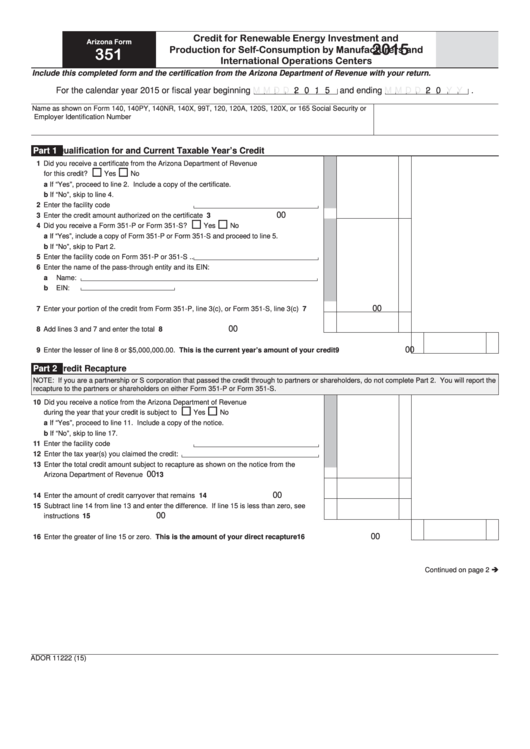

Credit for Renewable Energy Investment and

Arizona Form

2015

Production for Self-Consumption by Manufacturers and

351

International Operations Centers

Include this completed form and the certification from the Arizona Department of Revenue with your return.

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D

2 0

Y Y

.

Name as shown on Form 140, 140PY, 140NR, 140X, 99T, 120, 120A, 120S, 120X, or 165

Social Security or

Employer Identification Number

Part 1

Qualification for and Current Taxable Year’s Credit

1 Did you receive a certificate from the Arizona Department of Revenue

for this credit? .......................................................................................

Yes

No

a

If “Yes”, proceed to line 2. Include a copy of the certificate.

b

If “No”, skip to line 4.

2 Enter the facility code ..........................................

00

3 Enter the credit amount authorized on the certificate ............................................................

3

4 Did you receive a Form 351-P or Form 351-S? ....................................

Yes

No

a

If “Yes”, include a copy of Form 351-P or Form 351-S and proceed to line 5.

b

If “No”, skip to Part 2.

5 Enter the facility code on Form 351-P or 351-S ..

6 Enter the name of the pass-through entity and its EIN:

a

Name:

b

EIN:

00

7 Enter your portion of the credit from Form 351-P, line 3(c), or Form 351-S, line 3(c) ............

7

00

8 Add lines 3 and 7 and enter the total .....................................................................................

8

00

9 Enter the lesser of line 8 or $5,000,000.00. This is the current year’s amount of your credit .....................................

9

Credit Recapture

Part 2

NOTE: If you are a partnership or S corporation that passed the credit through to partners or shareholders, do not complete Part 2. You will report the

recapture to the partners or shareholders on either Form 351-P or Form 351-S.

10 Did you receive a notice from the Arizona Department of Revenue

during the year that your credit is subject to recapture.........................

Yes

No

a

If “Yes”, proceed to line 11. Include a copy of the notice.

b

If “No”, skip to line 17.

11 Enter the facility code ..........................................

12 Enter the tax year(s) you claimed the credit:

13 Enter the total credit amount subject to recapture as shown on the notice from the

00

Arizona Department of Revenue ..........................................................................................

13

00

14 Enter the amount of credit carryover that remains unused....................................................

14

15 Subtract line 14 from line 13 and enter the difference. If line 15 is less than zero, see

00

instructions ...........................................................................................................................

15

00

16 Enter the greater of line 15 or zero. This is the amount of your direct recapture.........................................................

16

Continued on page 2

ADOR 11222 (15)

1

1 2

2 3

3