Form Sc 1120v - Corporate Income Tax Payment Voucher

ADVERTISEMENT

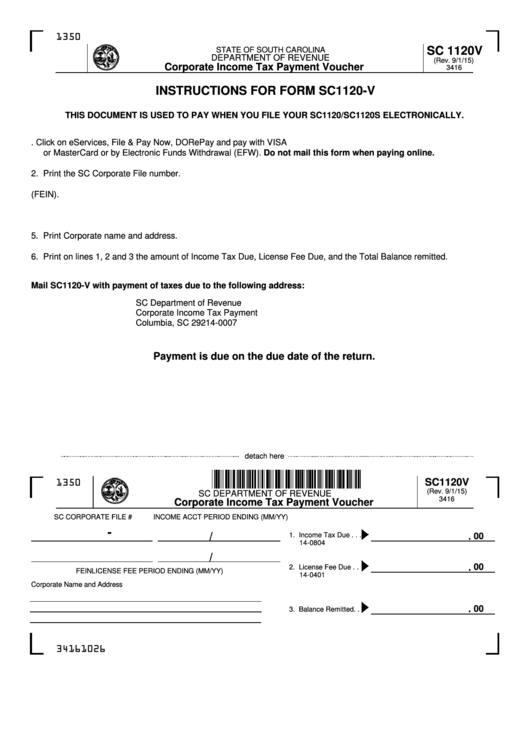

1350

SC 1120V

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 9/1/15)

Corporate Income Tax Payment Voucher

3416

INSTRUCTIONS FOR FORM SC1120-V

THIS DOCUMENT IS USED TO PAY WHEN YOU FILE YOUR SC1120/SC1120S ELECTRONICALLY.

1. File SC1120-V electronically at Click on eServices, File & Pay Now, DORePay and pay with VISA

or MasterCard or by Electronic Funds Withdrawal (EFW). Do not mail this form when paying online.

2. Print the SC Corporate File number.

3. Print the Federal Employer Identification Number (FEIN).

4. Print Income Tax and License Period Ending in the MM/YY format.

5. Print Corporate name and address.

6. Print on lines 1, 2 and 3 the amount of Income Tax Due, License Fee Due, and the Total Balance remitted.

Mail SC1120-V with payment of taxes due to the following address:

SC Department of Revenue

Corporate Income Tax Payment

Columbia, SC 29214-0007

Payment is due on the due date of the return.

detach here

SC1120V

1350

(Rev. 9/1/15)

SC DEPARTMENT OF REVENUE

3416

Corporate Income Tax Payment Voucher

SC CORPORATE FILE #

INCOME ACCT PERIOD ENDING (MM/YY)

-

/

.

1. Income Tax Due . . .

00

14-0804

/

.

00

2. License Fee Due . .

FEIN

LICENSE FEE PERIOD ENDING (MM/YY)

14-0401

Corporate Name and Address

.

00

3. Balance Remitted. .

34161026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1