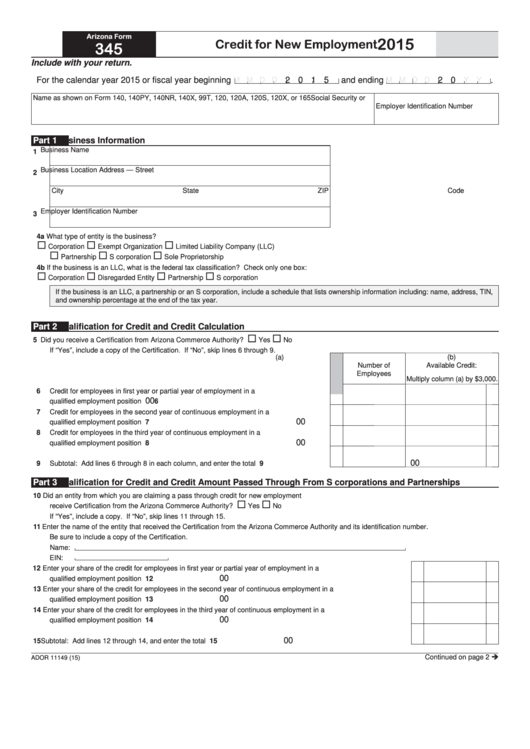

Arizona Form

2015

Credit for New Employment

345

Include with your return.

For the calendar year 2015 or fiscal year beginning

2 0 1 5 and ending

2 0

.

M M D D

M M D D

Y Y

Name as shown on Form 140, 140PY, 140NR, 140X, 99T, 120, 120A, 120S, 120X, or 165

Social Security or

Employer Identification Number

Part 1

Business Information

Business Name

1

Business Location Address — Street

2

City

State

ZIP Code

Employer Identification Number

3

4a What type of entity is the business?

Corporation

Exempt Organization

Limited Liability Company (LLC)

Partnership

S corporation

Sole Proprietorship

4b If the business is an LLC, what is the federal tax classification? Check only one box:

Corporation

Disregarded Entity

Partnership

S corporation

If the business is an LLC, a partnership or an S corporation, include a schedule that lists ownership information including: name, address, TIN,

and ownership percentage at the end of the tax year.

Qualification for Credit and Credit Calculation

Part 2

5

Did you receive a Certification from Arizona Commerce Authority? ............................................

Yes

No

If “Yes”, include a copy of the Certification. If “No”, skip lines 6 through 9.

(a)

(b)

Number of

Available Credit:

Employees

Multiply column (a) by $3,000.

6

Credit for employees in first year or partial year of employment in a

00

qualified employment position ...............................................................................................

6

7

Credit for employees in the second year of continuous employment in a

00

qualified employment position ...............................................................................................

7

8

Credit for employees in the third year of continuous employment in a

00

qualified employment position ...............................................................................................

8

00

9

Subtotal: Add lines 6 through 8 in each column, and enter the total ....................................

9

Part 3

Qualification for Credit and Credit Amount Passed Through From S corporations and Partnerships

10

Did an entity from which you are claiming a pass through credit for new employment

receive Certification from the Arizona Commerce Authority? ......................................................

Yes

No

If “Yes”, include a copy. If “No”, skip lines 11 through 15.

11

Enter the name of the entity that received the Certification from the Arizona Commerce Authority and its identification number.

Be sure to include a copy of the Certification.

Name:

EIN:

12

Enter your share of the credit for employees in first year or partial year of employment in a

00

qualified employment position ........................................................................................................................................

12

13

Enter your share of the credit for employees in the second year of continuous employment in a

00

qualified employment position ........................................................................................................................................

13

14

Enter your share of the credit for employees in the third year of continuous employment in a

00

qualified employment position ........................................................................................................................................

14

00

15

Subtotal: Add lines 12 through 14, and enter the total ...................................................................................................

15

Continued on page 2

ADOR 11149 (15)

1

1 2

2 3

3 4

4 5

5