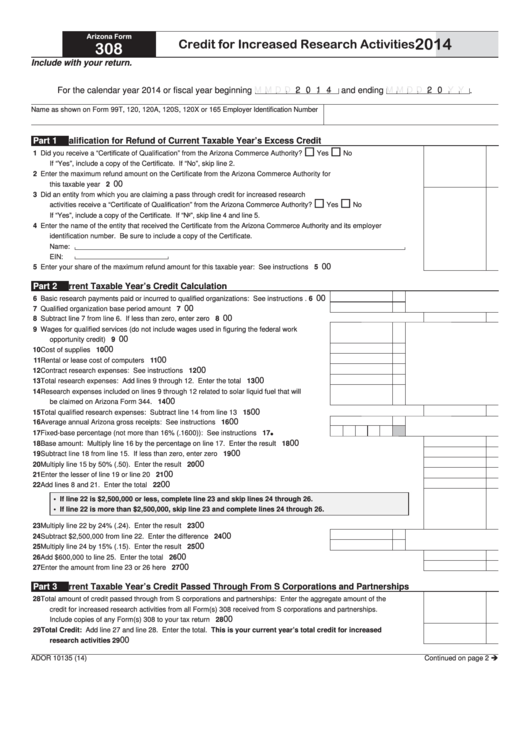

Arizona Form

2014

Credit for Increased Research Activities

308

Include with your return.

For the calendar year 2014 or fiscal year beginning

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

.

Name as shown on Form 99T, 120, 120A, 120S, 120X or 165

Employer Identification Number

Part 1

Qualification for Refund of Current Taxable Year’s Excess Credit

1

Did you receive a “Certificate of Qualification” from the Arizona Commerce Authority?.................

Yes

No

If “Yes”, include a copy of the Certificate. If “No”, skip line 2.

2

Enter the maximum refund amount on the Certificate from the Arizona Commerce Authority for

00

this taxable year ..............................................................................................................................................................

2

3

Did an entity from which you are claiming a pass through credit for increased research

activities receive a “Certificate of Qualification” from the Arizona Commerce Authority? ................

Yes

No

If “Yes”, include a copy of the Certificate. If “No”, skip line 4 and line 5.

4

Enter the name of the entity that received the Certificate from the Arizona Commerce Authority and its employer

identification number. Be sure to include a copy of the Certificate.

Name:

EIN:

00

5

Enter your share of the maximum refund amount for this taxable year: See instructions ..............................................

5

Part 2

Current Taxable Year’s Credit Calculation

00

6

Basic research payments paid or incurred to qualified organizations: See instructions . 6

00

7

Qualified organization base period amount ..................................................................... 7

00

8

Subtract line 7 from line 6. If less than zero, enter zero .................................................................................................

8

9

Wages for qualified services (do not include wages used in figuring the federal work

00

opportunity credit) ............................................................................................................ 9

00

10

Cost of supplies ............................................................................................................... 10

00

11

Rental or lease cost of computers ................................................................................... 11

00

12

Contract research expenses: See instructions ............................................................... 12

00

13

Total research expenses: Add lines 9 through 12. Enter the total ................................. 13

14

Research expenses included on lines 9 through 12 related to solar liquid fuel that will

00

be claimed on Arizona Form 344. .................................................................................... 14

00

15

Total qualified research expenses: Subtract line 14 from line 13 ................................................................................... 15

00

16

Average annual Arizona gross receipts: See instructions .............................................. 16

17

Fixed-base percentage (not more than 16% (.1600)): See instructions ......................... 17

00

18

Base amount: Multiply line 16 by the percentage on line 17. Enter the result ............................................................... 18

00

19

Subtract line 18 from line 15. If less than zero, enter zero ............................................................................................. 19

00

20

Multiply line 15 by 50% (.50). Enter the result ................................................................................................................ 20

00

21

Enter the lesser of line 19 or line 20 ................................................................................................................................ 21

00

22

Add lines 8 and 21. Enter the total ................................................................................................................................. 22

• If line 22 is $2,500,000 or less, complete line 23 and skip lines 24 through 26.

• If line 22 is more than $2,500,000, skip line 23 and complete lines 24 through 26.

00

23

Multiply line 22 by 24% (.24). Enter the result ................................................................................................................ 23

00

24

Subtract $2,500,000 from line 22. Enter the difference .................................................. 24

00

25

Multiply line 24 by 15% (.15). Enter the result ................................................................ 25

00

26

Add $600,000 to line 25. Enter the total ......................................................................................................................... 26

00

27

Enter the amount from line 23 or 26 here ........................................................................................................................ 27

Part 3

Current Taxable Year’s Credit Passed Through From S Corporations and Partnerships

28

Total amount of credit passed through from S corporations and partnerships: Enter the aggregate amount of the

credit for increased research activities from all Form(s) 308 received from S corporations and partnerships.

00

Include copies of any Form(s) 308 to your tax return ...................................................................................................... 28

29

Total Credit: Add line 27 and line 28. Enter the total. This is your current year’s total credit for increased

00

research activities ......................................................................................................................................................... 29

Continued on page 2

ADOR 10135 (14)

1

1 2

2 3

3 4

4