Form 45-009 - Estimated Income Tax Traditional Worksheet - 2015

ADVERTISEMENT

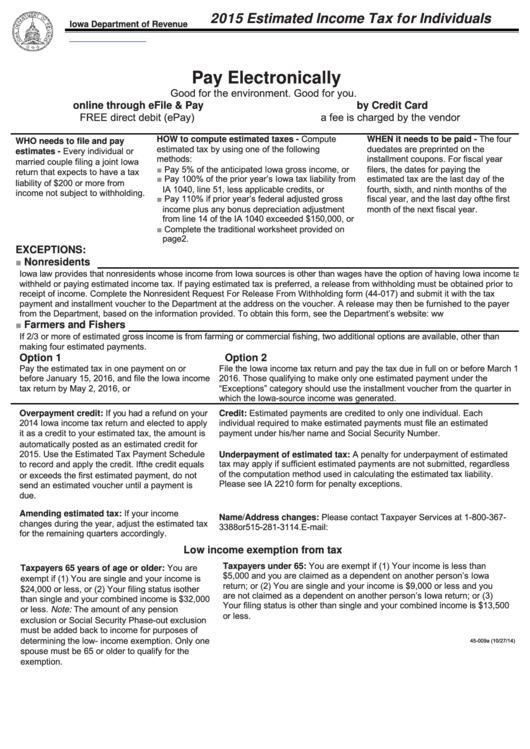

2015 Estimated Income Tax for Individuals

Iowa Department of Revenue

Pay Electronically

Good for the environment. Good for you.

online through eFile & Pay

by Credit Card

FREE direct debit (ePay)

a fee is charged by the vendor

HOW to compute estimated taxes - Compute

WHEN it needs to be paid - The four

WHO needs to file and pay

estimated tax by using one of the following

due dates are preprinted on the

estimates - Every individual or

methods:

installment coupons. For fiscal year

married couple filing a joint Iowa

■

Pay 5% of the anticipated Iowa gross income, or

filers, the dates for paying the

return that expects to have a tax

■

Pay 100% of the prior year’s Iowa tax liability from

estimated tax are the last day of the

liability of $200 or more from

IA 1040, line 51, less applicable credits, or

fourth, sixth, and ninth months of the

income not subject to withholding.

■

Pay 110% if prior year’s federal adjusted gross

fiscal year, and the last day of the first

income plus any bonus depreciation adjustment

month of the next fiscal year.

from line 14 of the IA 1040 exceeded $150,000, or

■

Complete the traditional worksheet provided on

page 2.

EXCEPTIONS:

■

Nonresidents

Iowa law provides that nonresidents whose income from Iowa sources is other than wages have the option of having Iowa income tax

withheld or paying estimated income tax. If paying estimated tax is preferred, a release from withholding must be obtained prior to

receipt of income. Complete the Nonresident Request For Release From Withholding form (44-017) and submit it with the tax

payment and installment voucher to the Department at the address on the voucher. A release may then be furnished to the payer

from the Department, based on the information provided. To obtain this form, see the Department’s website:

■

Farmers and Fishers

If 2/3 or more of estimated gross income is from farming or commercial fishing, two additional options are available, other than

making four estimated payments.

Option 1

Option 2

Pay the estimated tax in one payment on or

File the Iowa income tax return and pay the tax due in full on or before March 1,

before January 15, 2016, and file the Iowa income

2016. Those qualifying to make only one estimated payment under the

tax return by May 2, 2016, or

“Exceptions” category should use the installment voucher from the quarter in

which the Iowa-source income was generated.

Overpayment credit: If you had a refund on your

Credit: Estimated payments are credited to only one individual. Each

2014 Iowa income tax return and elected to apply

individual required to make estimated payments must file an estimated

it as a credit to your estimated tax, the amount is

payment under his/her name and Social Security Number.

automatically posted as an estimated credit for

Underpayment of estimated tax: A penalty for underpayment of estimated

2015. Use the Estimated Tax Payment Schedule

tax may apply if sufficient estimated payments are not submitted, regardless

to record and apply the credit. If the credit equals

of the computation method used in calculating the estimated tax liability.

or exceeds the first estimated payment, do not

Please see IA 2210 form for penalty exceptions.

send an estimated voucher until a payment is

due.

Amending estimated tax: If your income

Name/Address changes: Please contact Taxpayer Services at 1-800-367-

changes during the year, adjust the estimated tax

3388 or 515-281-3114. E-mail: idr@iowa.gov

for the remaining quarters accordingly.

Low income exemption from tax

Taxpayers under 65: You are exempt if (1) Your income is less than

Taxpayers 65 years of age or older: You are

$5,000 and you are claimed as a dependent on another person’s Iowa

exempt if (1) You are single and your income is

return; or (2) You are single and your income is $9,000 or less and you

$24,000 or less, or (2) Your filing status is other

are not claimed as a dependent on another person’s Iowa return; or (3)

than single and your combined income is $32,000

Your filing status is other than single and your combined income is $13,500

or less. Note: The amount of any pension

or less.

exclusion or Social Security Phase-out exclusion

must be added back to income for purposes of

determining the low- income exemption. Only one

45-009a (10/27/14)

spouse must be 65 or older to qualify for the

exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2