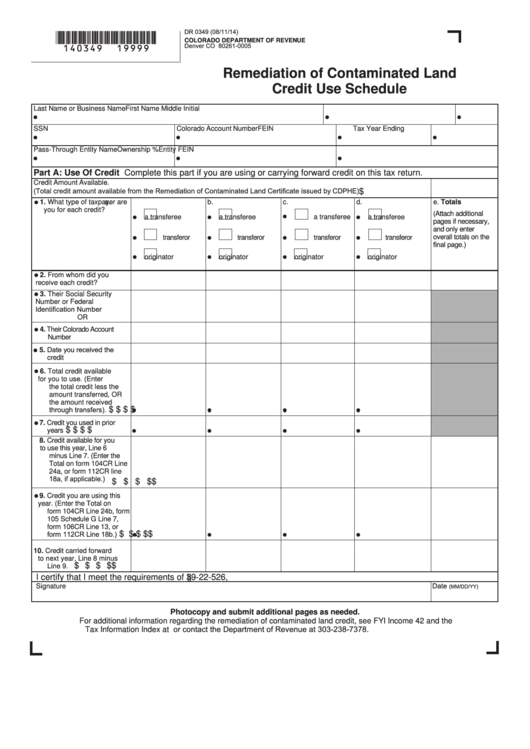

DR 0349 (08/11/14)

*140349==19999*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

Remediation of Contaminated Land

Credit Use Schedule

Last Name or Business Name

First Name

Middle Initial

SSN

Colorado Account Number

FEIN

Tax Year Ending

Pass-Through Entity Name

Ownership %

Entity FEIN

Part A: Use Of Credit Complete this part if you are using or carrying forward credit on this tax return.

Credit Amount Available.

(Total credit amount available from the Remediation of Contaminated Land Certificate issued by CDPHE)

$

1. What type of taxpayer are

a.

b.

c.

d.

e. Totals

you for each credit?

(Attach additional

a transferee

a transferee

a transferee

a transferee

pages if necessary,

and only enter

overall totals on the

transferor

transferor

transferor

transferor

final page.)

originator

originator

originator

originator

2. From whom did you

receive each credit?

3. Their Social Security

Number or Federal

Identification Number

OR

4. Their Colorado Account

Number

5. Date you received the

credit

6. Total credit available

for you to use. (Enter

the total credit less the

amount transferred, OR

the amount received

through transfers).

$

$

$

$

7. Credit you used in prior

$

$

$

$

years

8. Credit available for you

to use this year, Line 6

minus Line 7. (Enter the

Total on form 104CR Line

24a, or form 112CR line

18a, if applicable.)

$

$

$

$

$

9. Credit you are using this

year. (Enter the Total on

form 104CR Line 24b, form

105 Schedule G Line 7,

form 106CR Line 13, or

form 112CR Line 18b.)

$

$

$

$

$

10. Credit carried forward

to next year, Line 8 minus

$

$

$

$

$

Line 9.

I certify that I meet the requirements of 39-22-526, C.R.S.

Date

Signature

(MM/DD/YY)

Photocopy and submit additional pages as needed.

For additional information regarding the remediation of contaminated land credit, see FYI Income 42 and the

Tax Information Index at or contact the Department of Revenue at 303-238-7378.

1

1