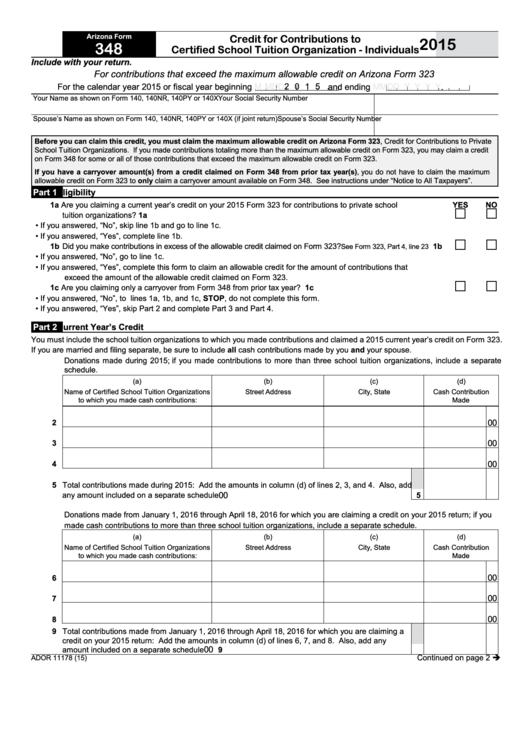

Arizona Form

Credit for Contributions to

2015

348

Certified School Tuition Organization - Individuals

Include with your return.

For contributions that exceed the maximum allowable credit on Arizona Form 323

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

Your Name as shown on Form 140, 140NR, 140PY or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return)

Spouse’s Social Security Number

Before you can claim this credit, you must claim the maximum allowable credit on Arizona Form 323, Credit for Contributions to Private

School Tuition Organizations. If you made contributions totaling more than the maximum allowable credit on Form 323, you may claim a credit

on Form 348 for some or all of those contributions that exceed the maximum allowable credit on Form 323.

If you have a carryover amount(s) from a credit claimed on Form 348 from prior tax year(s), you do not have to claim the maximum

allowable credit on Form 323 to only claim a carryover amount available on Form 348. See instructions under “Notice to All Taxpayers”.

Part 1

Eligibility

1a Are you claiming a current year’s credit on your 2015 Form 323 for contributions to private school

YES

NO

tuition organizations? ....................................................................................................................................... 1a

• If you answered, “No”, skip line 1b and go to line 1c.

• If you answered, “Yes”, complete line 1b.

1b Did you make contributions in excess of the allowable credit claimed on Form 323?

1b

See Form 323, Part 4, line 23

• If you answered, “No”, go to line 1c.

• If you answered, “Yes”, complete this form to claim an allowable credit for the amount of contributions that

exceed the amount of the allowable credit claimed on Form 323.

1c Are you claiming only a carryover from Form 348 from prior tax year? .......................................................... 1c

• If you answered, “No”, to lines 1a, 1b, and 1c, STOP, do not complete this form.

• If you answered, “Yes”, skip Part 2 and complete Part 3 and Part 4.

Part 2

Current Year’s Credit

You must include the school tuition organizations to which you made contributions and claimed a 2015 current year’s credit on Form 323.

If you are married and filing separate, be sure to include all cash contributions made by you and your spouse.

Donations made during 2015; if you made contributions to more than three school tuition organizations, include a separate

schedule.

(a)

(b)

(c)

(d)

Name of Certified School Tuition Organizations

Street Address

City, State

Cash Contribution

to which you made cash contributions:

Made

2

00

00

3

00

4

5 Total contributions made during 2015: Add the amounts in column (d) of lines 2, 3, and 4. Also, add

00

any amount included on a separate schedule .......................................................................................

5

Donations made from January 1, 2016 through April 18, 2016 for which you are claiming a credit on your 2015 return; if you

made cash contributions to more than three school tuition organizations, include a separate schedule.

(a)

(b)

(c)

(d)

Name of Certified School Tuition Organizations

Street Address

City, State

Cash Contribution

to which you made cash contributions:

Made

00

6

00

7

00

8

9 Total contributions made from January 1, 2016 through April 18, 2016 for which you are claiming a

credit on your 2015 return: Add the amounts in column (d) of lines 6, 7, and 8. Also, add any

00

amount included on a separate schedule .............................................................................................

9

Continued on page 2

ADOR 11178 (15)

1

1 2

2