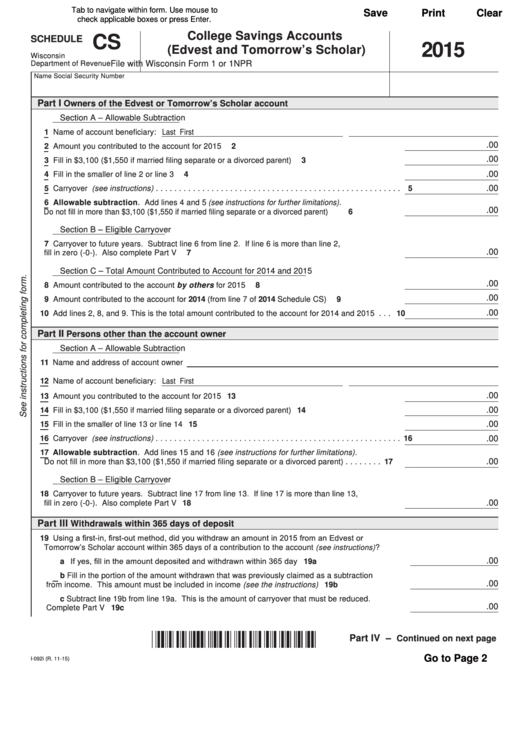

Tab to navigate within form. Use mouse to

Save

Print

Clear

check applicable boxes or press Enter.

College Savings Accounts

CS

SCHEDULE

2015

(Edvest and Tomorrow’s Scholar)

Wisconsin

File with Wisconsin Form 1 or 1NPR

Department of Revenue

Name

Social Security Number

Part I

Owners of the Edvest or Tomorrow’s Scholar account

Section A – Allowable Subtraction

1 Name of account beneficiary: Last

First

.00

2 Amount you contributed to the account for 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

3 Fill in $3,100 ($1,550 if married filing separate or a divorced parent) . . . . . . . . . . . . . . . . . . . . .

3

.00

4 Fill in the smaller of line 2 or line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

5 Carryover (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Allowable subtraction . Add lines 4 and 5 (see instructions for further limitations).

.00

Do not fill in more than $3,100 ($1,550 if married filing separate or a divorced parent) . . . . . . . . . . .

6

Section B – Eligible Carryover

7 Carryover to future years . Subtract line 6 from line 2 . If line 6 is more than line 2,

.00

fill in zero (-0-) . Also complete Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Section C – Total Amount Contributed to Account for 2014 and 2015

.00

8 Amount contributed to the account by others for 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

9 Amount contributed to the account for 2014 (from line 7 of 2014 Schedule CS) . . . . . . . . . . . . .

9

.00

10 Add lines 2, 8, and 9 . This is the total amount contributed to the account for 2014 and 2015 . . . 10

Part II

Persons other than the account owner

Section A – Allowable Subtraction

11 Name and address of account owner

12 Name of account beneficiary: Last

First

.00

13 Amount you contributed to the account for 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.00

14 Fill in $3,100 ($1,550 if married filing separate or a divorced parent) . . . . . . . . . . . . . . . . . . . . . 14

.00

15 Fill in the smaller of line 13 or line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Carryover (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Allowable subtraction . Add lines 15 and 16 (see instructions for further limitations) .

.00

Do not fill in more than $3,100 ($1,550 if married filing separate or a divorced parent) . . . . . . . . 17

Section B – Eligible Carryover

18 Carryover to future years . Subtract line 17 from line 13 . If line 17 is more than line 13,

.00

fill in zero (-0-) . Also complete Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Part III

Withdrawals within 365 days of deposit

19 Using a first-in, first-out method, did you withdraw an amount in 2015 from an Edvest or

Tomorrow’s Scholar account within 365 days of a contribution to the account (see instructions) ?

.00

a If yes, fill in the amount deposited and withdrawn within 365 day . . . . . . . . . . . . . . . . . . . . . . 19a

b Fill in the portion of the amount withdrawn that was previously claimed as a subtraction

.00

from income . This amount must be included in income (see the instructions) . . . . . . . . . . . . 19b

c Subtract line 19b from line 19a . This is the amount of carryover that must be reduced .

.00

Complete Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19c

Part IV –

Continued on next page

Go to Page 2

I-092i (R. 11-15)

1

1 2

2