Form 41-160 - Iowa Capital Gain Deduction Worksheet

ADVERTISEMENT

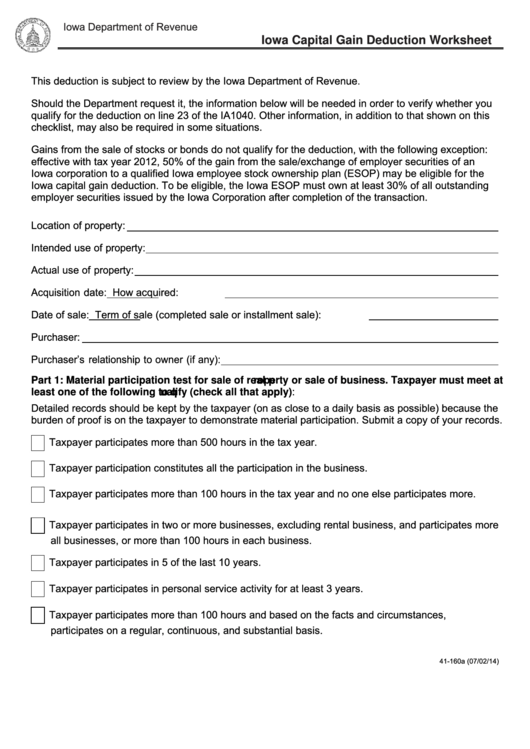

Iowa Department of Revenue

Iowa Capital Gain Deduction Worksheet

This deduction is subject to review by the Iowa Department of Revenue.

Should the Department request it, the information below will be needed in order to verify whether you

qualify for the deduction on line 23 of the IA1040. Other information, in addition to that shown on this

checklist, may also be required in some situations.

Gains from the sale of stocks or bonds do not qualify for the deduction, with the following exception:

effective with tax year 2012, 50% of the gain from the sale/exchange of employer securities of an

Iowa corporation to a qualified Iowa employee stock ownership plan (ESOP) may be eligible for the

Iowa capital gain deduction. To be eligible, the Iowa ESOP must own at least 30% of all outstanding

employer securities issued by the Iowa Corporation after completion of the transaction.

Location of property:

Intended use of property:

Actual use of property:

Acquisition date:

How acquired:

Date of sale:

Term of sale (completed sale or installment sale):

Purchaser:

Purchaser’s relationship to owner (if any):

Part 1: Material participation test for sale of real property or sale of business. Taxpayer must meet at

least one of the following to qualify (check all that apply):

Detailed records should be kept by the taxpayer (on as close to a daily basis as possible) because the

burden of proof is on the taxpayer to demonstrate material participation. Submit a copy of your records.

Taxpayer participates more than 500 hours in the tax year.

Taxpayer participation constitutes all the participation in the business.

Taxpayer participates more than 100 hours in the tax year and no one else participates more.

Taxpayer participates in two or more businesses, excluding rental business, and participates more

than 500 hours in

all businesses, or more than 100 hours in each business.

Taxpayer participates in 5 of the last 10 years.

Taxpayer participates in personal service activity for at least 3 years.

Taxpayer participates more than 100 hours and based on the facts and circumstances,

participates on a regular, continuous, and substantial basis.

41-160a (07/02/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2