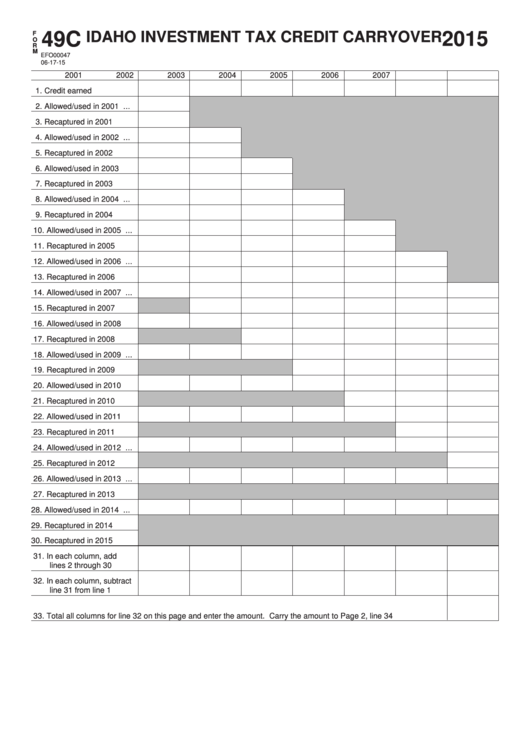

Form 49c - Idaho Investment Tax Credit Carryover - 2015

ADVERTISEMENT

F

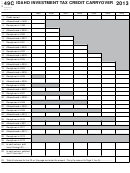

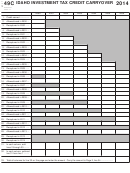

49C

IDAHO INVESTMENT TAX CREDIT CARRYOVER

2015

O

R

M

EFO00047

06-17-15

2001

2002

2003

2004

2005

2006

2007

1. Credit earned ...............

2. Allowed/used in 2001 ...

3. Recaptured in 2001 ......

4. Allowed/used in 2002 ...

5. Recaptured in 2002 ......

6. Allowed/used in 2003 ....

7. Recaptured in 2003 ......

8. Allowed/used in 2004 ...

9. Recaptured in 2004 ......

10. Allowed/used in 2005 ...

11. Recaptured in 2005 ......

12. Allowed/used in 2006 ...

13. Recaptured in 2006 ......

14. Allowed/used in 2007 ...

15. Recaptured in 2007 ......

16. Allowed/used in 2008 ....

17. Recaptured in 2008 ......

18. Allowed/used in 2009 ...

19. Recaptured in 2009 .....

20. Allowed/used in 2010 ....

21. Recaptured in 2010 ......

22. Allowed/used in 2011 ....

23. Recaptured in 2011 .......

24. Allowed/used in 2012 ...

25. Recaptured in 2012 ......

26. Allowed/used in 2013 ...

27. Recaptured in 2013 .....

28. Allowed/used in 2014 ...

29. Recaptured in 2014 ......

30. Recaptured in 2015 ......

31. In each column, add

lines 2 through 30 .........

32. In each column, subtract

line 31 from line 1 .........

33. Total all columns for line 32 on this page and enter the amount. Carry the amount to Page 2, line 34 .....................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3