Save

Print

Clear

Tab to navigate within form. Use mouse to check

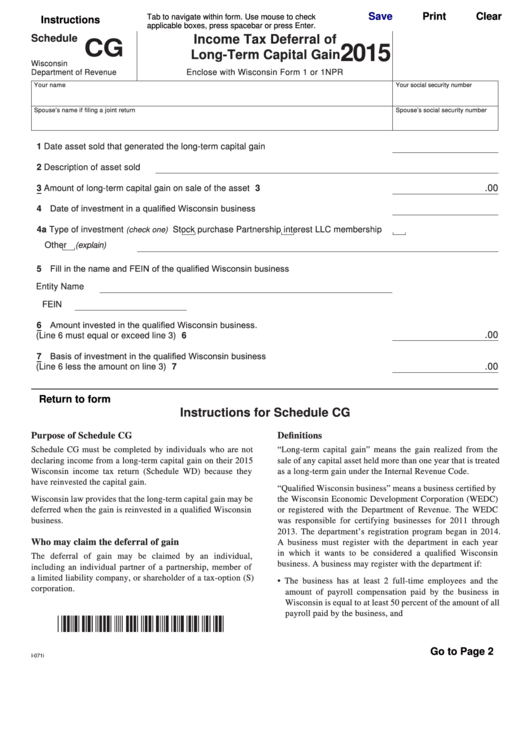

Instructions

applicable boxes, press spacebar or press Enter.

Schedule

Income Tax Deferral of

CG

2015

Long-Term Capital Gain

Wisconsin

Department of Revenue

Enclose with Wisconsin Form 1 or 1NPR

Your name

Your social security number

Spouse’s name if filing a joint return

Spouse’s social security number

1 Date asset sold that generated the long-term capital gain . . . . . . . . . . . . . . . . . . . .

2 Description of asset sold

.00

3 Amount of long-term capital gain on sale of the asset . . . . . . . . . . . . . . . . . . . . . . . 3

4 Date of investment in a qualified Wisconsin business . . . . . . . . . . . . . . . . . . . . . . . .

4a Type of investment

Stock purchase

Partnership interest

LLC membership

(check one)

Other

(explain)

5 Fill in the name and FEIN of the qualified Wisconsin business

Entity Name

FEIN

6 Amount invested in the qualified Wisconsin business.

.00

(Line 6 must equal or exceed line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Basis of investment in the qualified Wisconsin business

(Line 6 less the amount on line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

Return to form

Instructions for Schedule CG

Purpose of Schedule CG

Definitions

Schedule CG must be completed by individuals who are not

“Long-term capital gain” means the gain realized from the

declaring income from a long-term capital gain on their 2015

sale of any capital asset held more than one year that is treated

Wisconsin income tax return (Schedule WD) because they

as a long-term gain under the Internal Revenue Code.

have reinvested the capital gain.

“Qualified Wisconsin business” means a business certified by

Wisconsin law provides that the long-term capital gain may be

the Wisconsin Economic Development Corporation (WEDC)

deferred when the gain is reinvested in a qualified Wisconsin

or registered with the Department of Revenue. The WEDC

business.

was responsible for certifying businesses for 2011 through

2013. The department’s registration program began in 2014.

Who may claim the deferral of gain

A business must register with the department in each year

in which it wants to be considered a qualified Wisconsin

The deferral of gain may be claimed by an individual,

business. A business may register with the department if:

including an individual partner of a partnership, member of

a limited liability company, or shareholder of a tax-option (S)

• The business has at least 2 full-time employees and the

corporation.

amount of payroll compensation paid by the business in

Wisconsin is equal to at least 50 percent of the amount of all

payroll paid by the business, and

Go to Page 2

I-071i

1

1 2

2