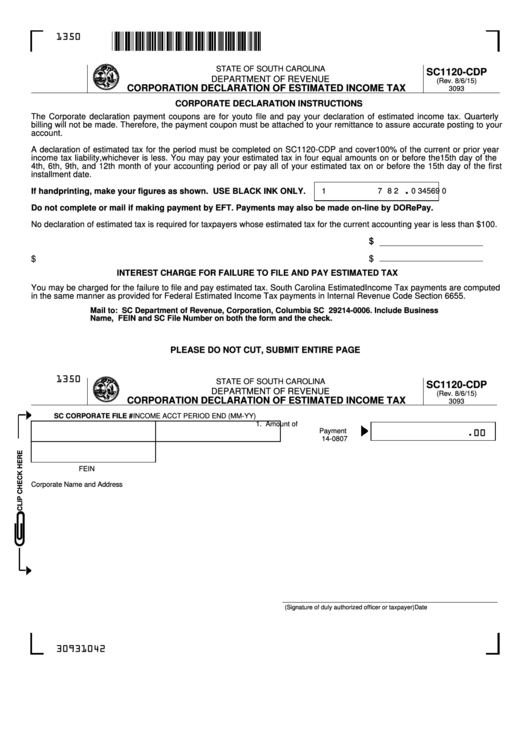

Form Sc1120-Cdp - Corporation Declaration Of Estimated Income Tax

ADVERTISEMENT

1350

STATE OF SOUTH CAROLINA

SC1120-CDP

DEPARTMENT OF REVENUE

(Rev. 8/6/15)

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

3093

CORPORATE DECLARATION INSTRUCTIONS

The Corporate declaration payment coupons are for you to file and pay your declaration of estimated income tax. Quarterly

billing will not be made. Therefore, the payment coupon must be attached to your remittance to assure accurate posting to your

account.

A declaration of estimated tax for the period must be completed on SC1120-CDP and cover 100% of the current or prior year

income tax liability, whichever is less. You may pay your estimated tax in four equal amounts on or before the 15th day of the

4th, 6th, 9th, and 12th month of your accounting period or pay all of your estimated tax on or before the 15th day of the first

installment date.

.

.

If handprinting, make your figures as shown. USE BLACK INK ONLY.

1

2

3 4 5 6

7

8

9

0

0

Do not complete or mail if making payment by EFT. Payments may also be made on-line by DORePay.

No declaration of estimated tax is required for taxpayers whose estimated tax for the current accounting year is less than $100.

$

$

A. Estimated tax for the current accounting year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A. Estimated tax for the current accounting year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. Overpayment from last year credited to estimated tax for this year. . . . . . . . . . . . . . . . . .

B. Overpayment from last year credited to estimated tax for this year. . . . . . . . . . . . . . . . . .

$

$

INTEREST CHARGE FOR FAILURE TO FILE AND PAY ESTIMATED TAX

You may be charged for the failure to file and pay estimated tax. South Carolina Estimated Income Tax payments are computed

in the same manner as provided for Federal Estimated Income Tax payments in Internal Revenue Code Section 6655.

Mail to: SC Department of Revenue, Corporation, Columbia SC 29214-0006. Include Business

Name, FEIN and SC File Number on both the form and the check.

PLEASE DO NOT CUT, SUBMIT ENTIRE PAGE

1350

STATE OF SOUTH CAROLINA

SC1120-CDP

DEPARTMENT OF REVENUE

(Rev. 8/6/15)

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

3093

SC CORPORATE FILE #

INCOME ACCT PERIOD END (MM-YY)

1. Amount of

.

.

Payment

00

14-0807

FEIN

Corporate Name and Address

(Signature of duly authorized officer or taxpayer)

Date

30931042

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1