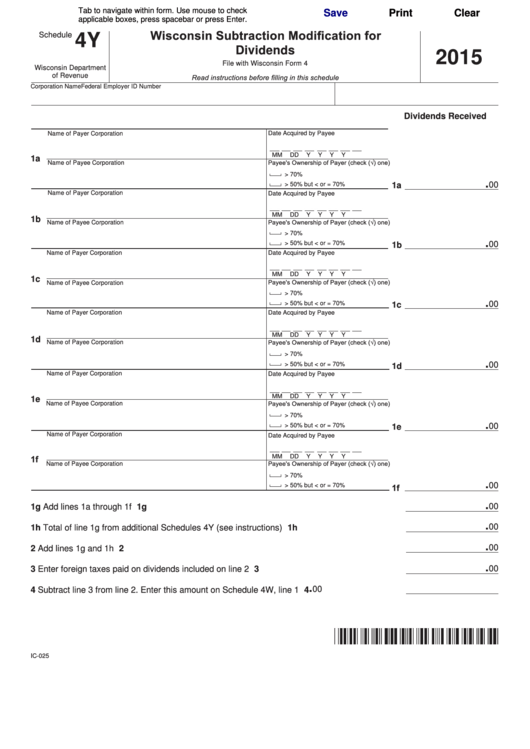

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Wisconsin Subtraction Modification for

Schedule

4Y

Dividends

2015

File with Wisconsin Form 4

Wisconsin Department

of Revenue

Read instructions before filling in this schedule

Corporation Name

Federal Employer ID Number

Dividends Received

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1a

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

00

> 50% but < or = 70%

1a

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1b

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1b

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1c

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1c

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1d

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1d

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1e

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1e

Name of Payer Corporation

Date Acquired by Payee

1f

M M

D

D

Y

Y

Y

Y

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

1f

00

> 50% but < or = 70%

.

00

1g Add lines 1a through 1f . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1g

.

00

1h Total of line 1g from additional Schedules 4Y (see instructions) . . . . . . . . . . . . . . . . . . . . . 1h

.

00

2

Add lines 1g and 1h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

00

3

Enter foreign taxes paid on dividends included on line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

00

4

Subtract line 3 from line 2 . Enter this amount on Schedule 4W, line 1 . . . . . . . . . . . . . . . . 4

IC-025

1

1