Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

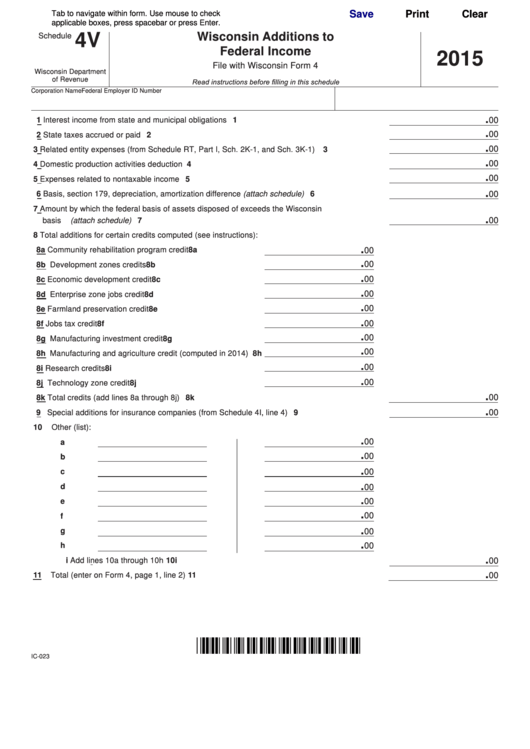

4V

Wisconsin Additions to

Schedule

Federal Income

2015

File with Wisconsin Form 4

Wisconsin Department

of Revenue

Read instructions before filling in this schedule

Corporation Name

Federal Employer ID Number

.

1

Interest income from state and municipal obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

.

00

2

State taxes accrued or paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

00

3

Related entity expenses (from Schedule RT, Part I, Sch . 2K-1, and Sch . 3K-1) . . . . . . . . . . 3

.

00

4

Domestic production activities deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.

00

5

Expenses related to nontaxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.

6

Basis, section 179, depreciation, amortization difference (attach schedule) . . . . . . . . . . . . . 6

00

7

Amount by which the federal basis of assets disposed of exceeds the Wisconsin

.

00

basis (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Total additions for certain credits computed (see instructions):

.

8a Community rehabilitation program credit . . . . . . . . . . . . 8a

00

.

00

8b Development zones credits . . . . . . . . . . . . . . . . . . . . . . 8b

.

00

8c Economic development credit . . . . . . . . . . . . . . . . . . . . 8c

.

00

8d Enterprise zone jobs credit . . . . . . . . . . . . . . . . . . . . . . 8d

.

00

8e Farmland preservation credit . . . . . . . . . . . . . . . . . . . . . 8e

.

00

8f Jobs tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8f

.

00

8g Manufacturing investment credit . . . . . . . . . . . . . . . . . . 8g

.

00

8h Manufacturing and agriculture credit (computed in 2014) 8h

.

00

8i Research credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8i

.

00

8j Technology zone credit . . . . . . . . . . . . . . . . . . . . . . . . . 8j

.

00

8k Total credits (add lines 8a through 8j) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8k

.

00

9

Special additions for insurance companies (from Schedule 4I, line 4) . . . . . . . . . . . . . . . . . . 9

10

Other (list):

.

00

a

.

00

b

.

c

00

.

d

00

.

e

00

.

00

f

.

g

00

.

00

h

.

i

Add lines 10a through 10h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10i

00

.

11

Total (enter on Form 4, page 1, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

IC-023

1

1