Instructions For Arizona Form 304 - Enterprise Zone Credit - 2014

ADVERTISEMENT

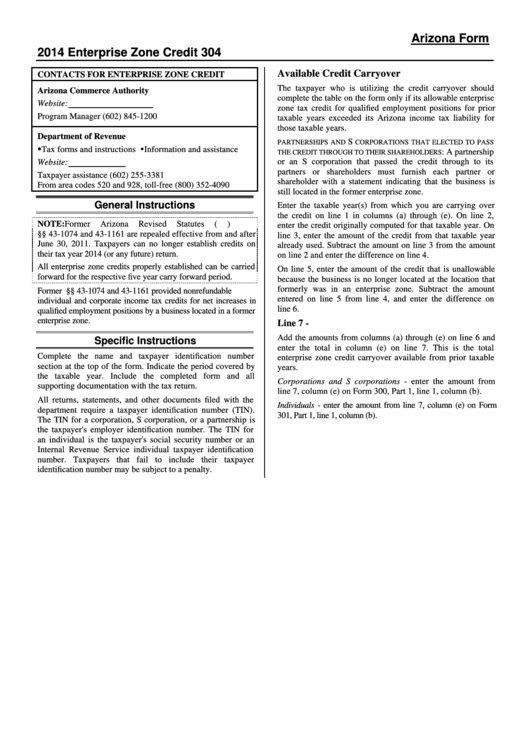

Arizona Form

2014 Enterprise Zone Credit

304

Available Credit Carryover

CONTACTS FOR ENTERPRISE ZONE CREDIT

The taxpayer who is utilizing the credit carryover should

Arizona Commerce Authority

complete the table on the form only if its allowable enterprise

Website:

zone tax credit for qualified employment positions for prior

Program Manager

(602) 845-1200

taxable years exceeded its Arizona income tax liability for

those taxable years.

Department of Revenue

S

PARTNERSHIPS AND

CORPORATIONS THAT ELECTED TO PASS

Tax forms and instructions Information and assistance

: A partnership

THE CREDIT THROUGH TO THEIR SHAREHOLDERS

or an S corporation that passed the credit through to its

Website:

partners or shareholders must furnish each partner or

Taxpayer assistance

(602) 255-3381

shareholder with a statement indicating that the business is

From area codes 520 and 928, toll-free

(800) 352-4090

still located in the former enterprise zone.

General Instructions

Enter the taxable year(s) from which you are carrying over

the credit on line 1 in columns (a) through (e). On line 2,

NOTE:

Former

Arizona

Revised

Statutes

(A.R.S.)

enter the credit originally computed for that taxable year. On

§§ 43-1074 and 43-1161 are repealed effective from and after

line 3, enter the amount of the credit from that taxable year

June 30, 2011. Taxpayers can no longer establish credits on

already used. Subtract the amount on line 3 from the amount

their tax year 2014 (or any future) return.

on line 2 and enter the difference on line 4.

All enterprise zone credits properly established can be carried

On line 5, enter the amount of the credit that is unallowable

forward for the respective five year carry forward period.

because the business is no longer located at the location that

formerly was in an enterprise zone. Subtract the amount

Former A.R.S. §§ 43-1074 and 43-1161 provided nonrefundable

entered on line 5 from line 4, and enter the difference on

individual and corporate income tax credits for net increases in

line 6.

qualified employment positions by a business located in a former

enterprise zone.

Line 7 -

Add the amounts from columns (a) through (e) on line 6 and

Specific Instructions

enter the total in column (e) on line 7. This is the total

Complete the name and taxpayer identification number

enterprise zone credit carryover available from prior taxable

section at the top of the form. Indicate the period covered by

years.

the taxable year. Include the completed form and all

Corporations and S corporations - enter the amount from

supporting documentation with the tax return.

line 7, column (e) on Form 300, Part 1, line 1, column (b).

All returns, statements, and other documents filed with the

Individuals - enter the amount from line 7, column (e) on Form

department require a taxpayer identification number (TIN).

301, Part 1, line 1, column (b).

The TIN for a corporation, S corporation, or a partnership is

the taxpayer's employer identification number. The TIN for

an individual is the taxpayer's social security number or an

Internal Revenue Service individual taxpayer identification

number. Taxpayers that fail to include their taxpayer

identification number may be subject to a penalty.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1