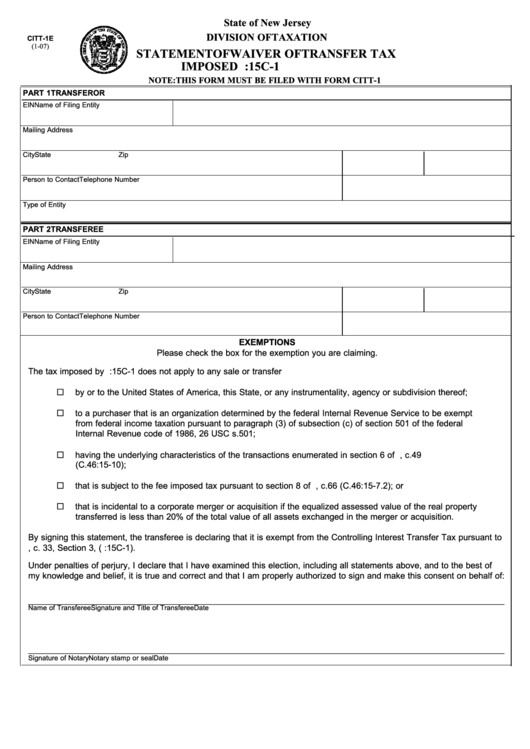

State of New Jersey

DIVISION OF TAXATION

CITT-1E

(1-07)

STATEMENT OF WAIVER OF TRANSFER TAX

IMPOSED BY N.J.S.A. 54:15C-1

NOTE: THIS FORM MUST BE FILED WITH FORM CITT-1

PART 1

TRANSFEROR

EIN

Name of Filing Entity

Mailing Address

City

State

Zip

Person to Contact

Telephone Number

Type of Entity

PART 2

TRANSFEREE

EIN

Name of Filing Entity

Mailing Address

City

State

Zip

Person to Contact

Telephone Number

EXEMPTIONS

Please check the box for the exemption you are claiming.

The tax imposed by N.J.S.A. 54:15C-1 does not apply to any sale or transfer

by or to the United States of America, this State, or any instrumentality, agency or subdivision thereof;

to a purchaser that is an organization determined by the federal Internal Revenue Service to be exempt

from federal income taxation pursuant to paragraph (3) of subsection (c) of section 501 of the federal

Internal Revenue code of 1986, 26 USC s.501;

having the underlying characteristics of the transactions enumerated in section 6 of P.L. 1968, c.49

(C.46:15-10);

that is subject to the fee imposed tax pursuant to section 8 of P.L. 2004, c.66 (C.46:15-7.2); or

that is incidental to a corporate merger or acquisition if the equalized assessed value of the real property

transferred is less than 20% of the total value of all assets exchanged in the merger or acquisition.

By signing this statement, the transferee is declaring that it is exempt from the Controlling Interest Transfer Tax pursuant to

P.L. 2006, c. 33, Section 3, (N.J.S.A. 54:15C-1).

Under penalties of perjury, I declare that I have examined this election, including all statements above, and to the best of

my knowledge and belief, it is true and correct and that I am properly authorized to sign and make this consent on behalf of:

___________________________________________________________________________________________

Name of Transferee

Signature and Title of Transferee

Date

___________________________________________________________________________________________

Signature of Notary

Notary stamp or seal

Date

1

1