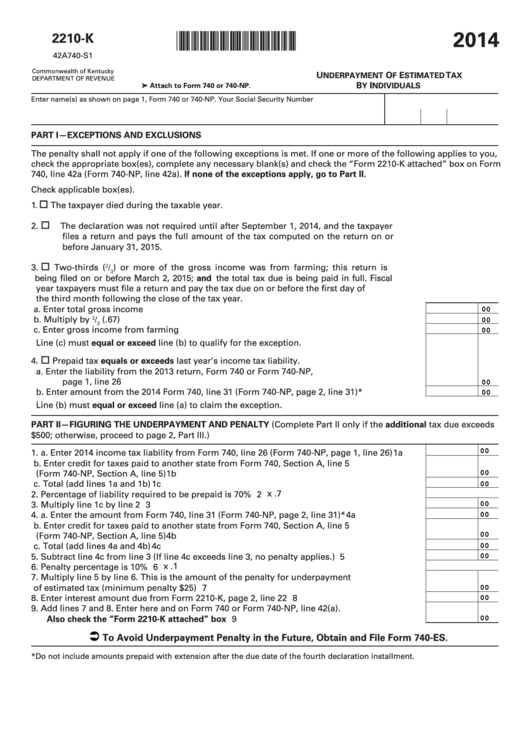

2014

2210-K

*1400030022*

42A740-S1

Commonwealth of Kentucky

U

O

E

T

NDERPAYMENT

F

STIMATED

AX

DEPARTMENT OF REVENUE

B

I

Y

NDIVIDUALS

➤ Attach to Form 740 or 740-NP .

Enter name(s) as shown on page 1, Form 740 or 740-NP .

Your Social Security Number

PART I—EXCEPTIONS AND EXCLUSIONS

The penalty shall not apply if one of the following exceptions is met. If one or more of the following applies to you,

check the appropriate box(es), complete any necessary blank(s) and check the “Form 2210-K attached” box on Form

740, line 42a (Form 740-NP , line 42a). If none of the exceptions apply, go to Part II.

Check applicable box(es).

1.

The taxpayer died during the taxable year.

2.

The declaration was not required until after September 1, 2014, and the taxpayer

files a return and pays the full amount of the tax computed on the return on or

before January 31, 2015.

3.

Two-thirds (

/

) or more of the gross income was from farming; this return is

2

3

being filed on or before March 2, 2015; and the total tax due is being paid in full. Fiscal

year taxpayers must file a return and pay the tax due on or before the first day of

the third month following the close of the tax year.

a. Enter total gross income ......................................................................................................

00

b. Multiply by

/

(.67) ...............................................................................................................

2

00

3

c. Enter gross income from farming .......................................................................................

00

Line (c) must equal or exceed line (b) to qualify for the exception.

4.

Prepaid tax equals or exceeds last year’s income tax liability.

a. Enter the liability from the 2013 return, Form 740 or Form 740-NP ,

page 1, line 26 .......................................................................................................................

00

b. Enter amount from the 2014 Form 740, line 31 (Form 740-NP , page 2, line 31)* .............

00

Line (b) must equal or exceed line (a) to claim the exception.

PART II—FIGURING THE UNDERPAYMENT AND PENALTY (Complete Part II only if the additional tax due exceeds

$500; otherwise, proceed to page 2, Part III.)

00

1.

a. Enter 2014 income tax liability from Form 740, line 26 (Form 740-NP , page 1, line 26) .... 1a

b. Enter credit for taxes paid to another state from Form 740, Section A, line 5

(Form 740-NP , Section A, line 5) ............................................................................................ 1b

00

c. Total (add lines 1a and 1b) .................................................................................................... 1c

00

x .7

2. Percentage of liability required to be prepaid is 70% .............................................................. 2

3. Multiply line 1c by line 2 ............................................................................................................. 3

00

4. a. Enter the amount from Form 740, line 31 (Form 740-NP , page 2, line 31)* ....................... 4a

00

b. Enter credit for taxes paid to another state from Form 740, Section A, line 5

00

(Form 740-NP , Section A, line 5) ............................................................................................ 4b

c. Total (add lines 4a and 4b) .................................................................................................... 4c

00

5. Subtract line 4c from line 3 (If line 4c exceeds line 3, no penalty applies.)............................ 5

00

x .1

6. Penalty percentage is 10% .......................................................................................................... 6

7.

Multiply line 5 by line 6. This is the amount of the penalty for underpayment

of estimated tax (minimum penalty $25) .................................................................................. 7

00

8. Enter interest amount due from Form 2210-K, page 2, line 22 ................................................ 8

00

9. Add lines 7 and 8. Enter here and on Form 740 or Form 740-NP , line 42(a).

Also check the “Form 2210-K attached” box ............................................................................ 9

00

To Avoid Underpayment Penalty in the Future, Obtain and File Form 740-ES.

*Do not include amounts prepaid with extension after the due date of the fourth declaration installment.

1

1 2

2 3

3