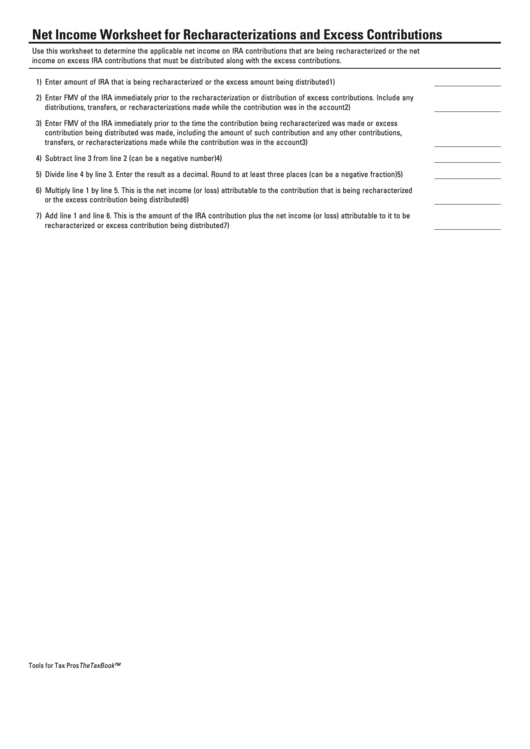

Net Income Worksheet for Recharacterizations and Excess Contributions

Use this worksheet to determine the applicable net income on IRA contributions that are being recharacterized or the net

income on excess IRA contributions that must be distributed along with the excess contributions.

1) Enter amount of IRA that is being recharacterized or the excess amount being distributed

1)

. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. .

2) Enter FMV of the IRA immediately prior to the recharacterization or distribution of excess contributions. Include any

distributions, transfers, or recharacterizations made while the contribution was in the account

2)

. .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . ..

3) Enter FMV of the IRA immediately prior to the time the contribution being recharacterized was made or excess

contribution being distributed was made, including the amount of such contribution and any other contributions,

transfers, or recharacterizations made while the contribution was in the account

3)

.. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . ..

4) Subtract line 3 from line 2 (can be a negative number)

4)

...... ..... .... ..... ..... .... .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .

5) Divide line 4 by line 3. Enter the result as a decimal. Round to at least three places (can be a negative fraction)

5)

.. . .. .. . .. ..

6) Multiply line 1 by line 5. This is the net income (or loss) attributable to the contribution that is being recharacterized

or the excess contribution being distributed

6)

......................... .... ..... ..... .... .... .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . ..

7) Add line 1 and line 6. This is the amount of the IRA contribution plus the net income (or loss) attributable to it to be

recharacterized or excess contribution being distributed

7)

.... .... ..... ..... .... ..... . . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .. . .. .. . .. .. . .. .. . .. . .. .

Tools for Tax Pros

TheTaxBook™

1

1