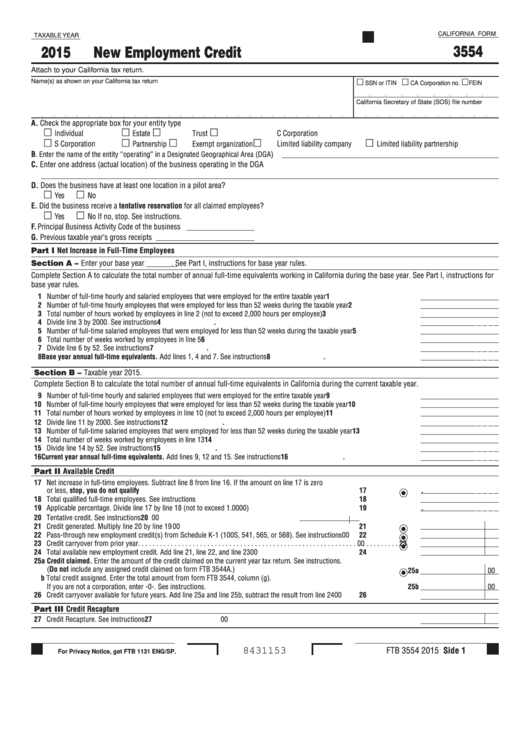

Form 3554 - California New Employment Credit - 2015

ADVERTISEMENT

CALIFORNIA FORM

TAXABLE YEAR

3554

2015

New Employment Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State (SOS) file number

A. Check the appropriate box for your entity type

Individual

Estate

Trust

C Corporation

S Corporation

Partnership

Exempt organization

Limited liability company

Limited liability partnership

B.

)

Enter the name of the entity “operating” in a Designated Geographical Area (DGA

C. Enter one address (actual location) of the business operating in the DGA

D. Does the business have at least one location in a pilot area?

Yes

No

E. Did the business receive a tentative reservation for all claimed employees?

Yes

No

If no, stop. See instructions.

F. Principal Business Activity Code of the business

G. Previous taxable year’s gross receipts

Part I Net Increase in Full-Time Employees

Section A – Enter your base year

. See Part I, instructions for base year rules.

Complete Section A to calculate the total number of annual full-time equivalents working in California during the base year. See Part I, instructions for

base year rules.

1 Number of full-time hourly and salaried employees that were employed for the entire taxable year . . . . . . . . . . . . . . . . . . . .

1

2 Number of full-time hourly employees that were employed for less than 52 weeks during the taxable year . . . . . . . . . . . . . .

2

3 Total number of hours worked by employees in line 2 (not to exceed 2,000 hours per employee) . . . . . . . . . . . . . . . . . . . . .

3

4 Divide line 3 by 2000. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

5 Number of full-time salaried employees that were employed for less than 52 weeks during the taxable year . . . . . . . . . . . . .

5

6 Total number of weeks worked by employees in line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Divide line 6 by 52. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

8 Base year annual full-time equivalents. Add lines 1, 4 and 7. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

Section B – Taxable year 2015.

Complete Section B to calculate the total number of annual full-time equivalents in California during the current taxable year.

9 Number of full-time hourly and salaried employees that were employed for the entire taxable year . . . . . . . . . . . . . . . . . . . .

9

10 Number of full-time hourly employees that were employed for less than 52 weeks during the taxable year . . . . . . . . . . . . . .

10

11 Total number of hours worked by employees in line 10 (not to exceed 2,000 hours per employee) . . . . . . . . . . . . . . . . . . . .

11

12 Divide line 11 by 2000. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

.

13 Number of full-time salaried employees that were employed for less than 52 weeks during the taxable year . . . . . . . . . . . . .

13

14 Total number of weeks worked by employees in line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Divide line 14 by 52. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

.

16 Current year annual full-time equivalents. Add lines 9, 12 and 15. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

.

Part II Available Credit

17 Net increase in full-time employees. Subtract line 8 from line 16. If the amount on line 17 is zero

or less, stop, you do not qualify . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

17

.

18 Total qualified full-time employees. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

18

19 Applicable percentage. Divide line 17 by line 18 (not to exceed 1.0000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

19

.

20 Tentative credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

00

21 Credit generated. Multiply line 20 by line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

21

00

22 Pass-through new employment credit(s) from Schedule K-1 (100S, 541, 565, or 568). See instructions . . . .

. . . . . . . . . . .

22

00

23 Credit carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

23

00

24 Total available new employment credit. Add line 21, line 22, and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

24

00

25a Credit claimed. Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544A.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

25a

00

b Total credit assigned. Enter the total amount from form FTB 3544, column (g).

If you are not a corporation, enter -0-. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

25b

00

26 Credit carryover available for future years. Add line 25a and line 25b, subtract the result from line 24 . . . . . .

. . . . . . . . . . .

26

00

Part III Credit Recapture

27 Credit Recapture. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

FTB 3554 2015 Side 1

8431153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1