New Markets Capital Investment Credit Worksheet For Tax Year 2015

ADVERTISEMENT

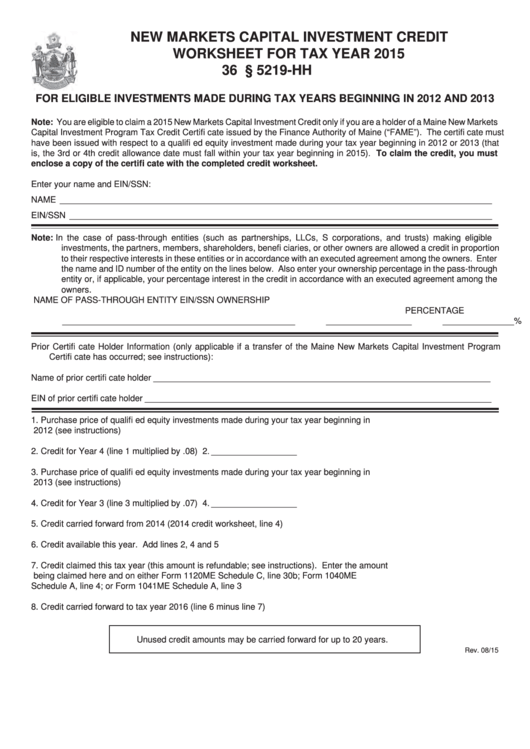

NEW MARKETS CAPITAL INVESTMENT CREDIT

WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5219-HH

FOR ELIGIBLE INVESTMENTS MADE DURING TAX YEARS BEGINNING IN 2012 AND 2013

Note: You are eligible to claim a 2015 New Markets Capital Investment Credit only if you are a holder of a Maine New Markets

Capital Investment Program Tax Credit Certifi cate issued by the Finance Authority of Maine (“FAME”). The certifi cate must

have been issued with respect to a qualifi ed equity investment made during your tax year beginning in 2012 or 2013 (that

is, the 3rd or 4th credit allowance date must fall within your tax year beginning in 2015). To claim the credit, you must

enclose a copy of the certifi cate with the completed credit worksheet.

Enter your name and EIN/SSN:

NAME ___________________________________________________________________________________________

EIN/SSN _________________________________________________________________________________________

Note: In the case of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making eligible

investments, the partners, members, shareholders, benefi ciaries, or other owners are allowed a credit in proportion

to their respective interests in these entities or in accordance with an executed agreement among the owners. Enter

the name and ID number of the entity on the lines below. Also enter your ownership percentage in the pass-through

entity or, if applicable, your percentage interest in the credit in accordance with an executed agreement among the

owners.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

OWNERSHIP

PERCENTAGE

_________________________________________________

__________________

_______________ %

Prior Certifi cate Holder Information (only applicable if a transfer of the Maine New Markets Capital Investment Program

Certifi cate has occurred; see instructions):

Name of prior certifi cate holder _______________________________________________________________________

EIN of prior certifi cate holder _________________________________________________________________________

1.

Purchase price of qualifi ed equity investments made during your tax year beginning in

2012 (see instructions) ............................................................................................................ 1. __________________

2.

Credit for Year 4 (line 1 multiplied by .08) ............................................................................... 2. __________________

3.

Purchase price of qualifi ed equity investments made during your tax year beginning in

2013 (see instructions) ............................................................................................................ 3. __________________

4.

Credit for Year 3 (line 3 multiplied by .07) ............................................................................... 4. __________________

5.

Credit carried forward from 2014 (2014 credit worksheet, line 4) ........................................... 5. __________________

6.

Credit available this year. Add lines 2, 4 and 5 ...................................................................... 6. __________________

7.

Credit claimed this tax year (this amount is refundable; see instructions). Enter the amount

being claimed here and on either Form 1120ME Schedule C, line 30b; Form 1040ME

Schedule A, line 4; or Form 1041ME Schedule A, line 3 ........................................................ 7. __________________

8.

Credit carried forward to tax year 2016 (line 6 minus line 7) .................................................. 8. __________________

Unused credit amounts may be carried forward for up to 20 years.

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2