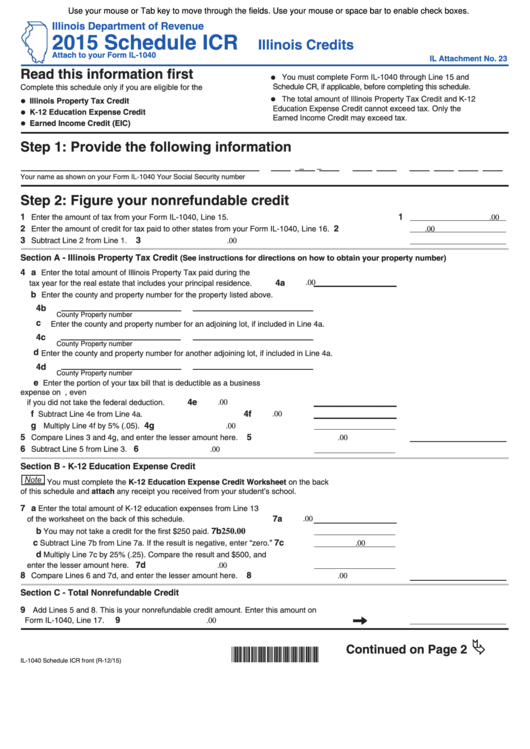

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2015 Schedule ICR

Illinois Credits

Attach to your Form IL-1040

IL Attachment No. 23

Read this information first

You must complete Form IL-1040 through Line 15 and

Schedule CR, if applicable, before completing this schedule.

Complete this schedule only if you are eligible for the

The total amount of Illinois Property Tax Credit and K-12

Illinois Property Tax Credit

Education Expense Credit cannot exceed tax. Only the

K-12 Education Expense Credit

Earned Income Credit may exceed tax.

Earned Income Credit (EIC)

Step 1: Provide the following information

–

–

Your name as shown on your Form IL-1040

Your Social Security number

Step 2: Figure your nonrefundable credit

1

1

Enter the amount of tax from your Form IL-1040, Line 15.

.00

2

2

Enter the amount of credit for tax paid to other states from your Form IL-1040, Line 16.

.00

3

3

Subtract Line 2 from Line 1.

.00

Section A - Illinois Property Tax Credit

(See instructions for directions on how to obtain your property number)

4 a

Enter the total amount of Illinois Property Tax paid during the

4a

.00

tax year for the real estate that includes your principal residence.

b

Enter the county and property number for the property listed above.

4b

County

Property number

c

Enter the county and property number for an adjoining lot, if included in Line 4a.

4c

County

Property number

d

Enter the county and property number for another adjoining lot, if included in Line 4a.

4d

County

Property number

e

Enter the portion of your tax bill that is deductible as a business

expense on U.S. income tax forms or schedules, even

4e

if you did not take the federal deduction.

.00

f

4f

Subtract Line 4e from Line 4a.

.00

g

4g

Multiply Line 4f by 5% (.05).

.00

5

5

Compare Lines 3 and 4g, and enter the lesser amount here.

.00

6

6

Subtract Line 5 from Line 3.

.00

Section B - K-12 Education Expense Credit

You must complete the K-12 Education Expense Credit Worksheet on the back

of this schedule and attach any receipt you received from your student’s school.

7 a

Enter the total amount of K-12 education expenses from Line 13

7a

of the worksheet on the back of this schedule.

.00

b

7b

250.00

You may not take a credit for the first $250 paid.

c

7c

Subtract Line 7b from Line 7a. If the result is negative, enter “zero.”

.00

d

Multiply Line 7c by 25% (.25). Compare the result and $500, and

7d

enter the lesser amount here.

.00

8

8

Compare Lines 6 and 7d, and enter the lesser amount here.

.00

Section C - Total Nonrefundable Credit

9

Add Lines 5 and 8. This is your nonrefundable credit amount. Enter this amount on

9

Form IL-1040, Line 17.

.00

Continued on Page 2

*560501110*

IL-1040 Schedule ICR front (R-12/15)

1

1 2

2