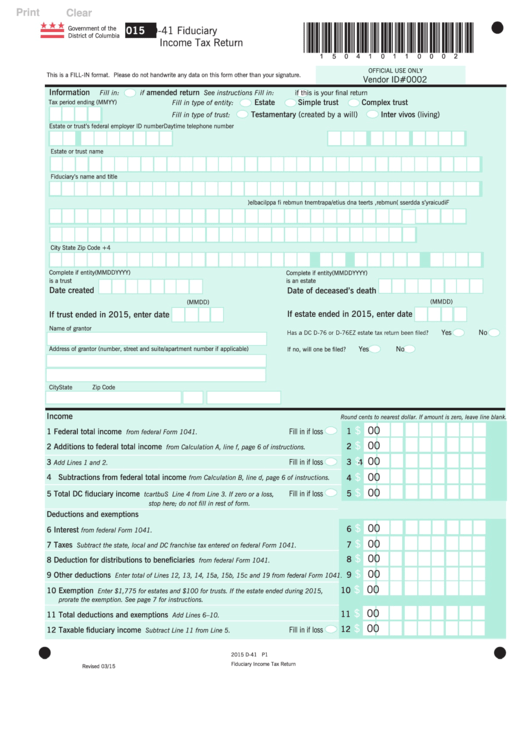

Print

Clear

*150410110002*

2015

D-41 Fiduciary

Government of the

District of Columbia

Income Tax Return

OFFICIAL USE ONLY

This is a FILL-IN format. Please do not handwrite any data on this form other than your signature.

Vendor ID#0002

Information

amended return

Fill in:

if

See instructions

Fill in:

if this is your final return

Estate

Simple trust

Complex trust

Tax period ending (MMYY)

Fill in type of entity:

Testamentary (created by a will)

Inter vivos (living)

Fill in type of trust:

Estate or trust’s federal employer ID number

Daytime telephone number

Estate or trust name

Fiduciary’s name and title

F

d i

c u

a i

y r

s ’

d a

d

e r

s s

n (

u

m

b

, r e

t s

e r

t e

n a

d

u s

e t i

a /

a p

t r

m

e

t n

n

u

m

b

r e

f i

p a

i l p

a c

l b

) e

City

State

Zip Code +4

Complete if entity

(MMDDYYYY)

Complete if entity

(MMDDYYYY)

is a trust

is an estate

Date created

Date of deceased’s death

(MMDD)

(MMDD)

If estate ended in 2015, enter date

If trust ended in 2015, enter date

Name of grantor

Yes

No

Yes

No

Address of grantor (number, street and suite/apartment number if applicable)

If no, will one be filed?

City

State

Zip Code

Income

Round cents to nearest dollar. If amount is zero, leave line blank.

.

$

00

1

1 Federal total income

Fill in if loss

from federal Form 1041.

.

$

00

2

2 Additions to federal total income

from Calculation A, line f, page 6 of instructions.

.

$

00

3

Fill in if loss

3

4

Add Lines 1 and 2.

.

$

00

4 Subtractions from federal total income

4

from Calculation B, line d, page 6 of instructions.

.

$

00

5

5 Total DC fiduciary income

Fill in if loss

S

u

t b

a r

t c

Line 4 from Line 3. If zero or a loss,

stop here; do not fill in rest of form.

Deductions and exemptions

.

$

00

6

6 Interest

from federal Form 1041.

.

$

00

7 Taxes

7

Subtract the state, local and DC franchise tax entered on federal Form 1041.

.

$

00

8

8 Deduction for distributions to beneficiaries

from federal Form 1041.

.

$

00

9

9 Other deductions

Enter total of Lines 12, 13, 14, 15a, 15b, 15c and 19 from federal Form 1041.

.

$

00

10

10 Exemption

Enter $1,775 for estates and $100 for trusts. If the estate ended during 2015,

prorate the exemption. See page 7 for instructions.

.

$

00

11

11 Total deductions and exemptions

Add Lines 6–10.

.

$

00

12

12 Taxable fiduciary income

Fill in if loss

Subtract Line 11 from Line 5.

2015 D-41 P1

Fiduciary Income Tax Return

Revised 03/15

1

1 2

2