Instructions For Form 347 - Credit For Qualified Health Insurance Plans - 2014

ADVERTISEMENT

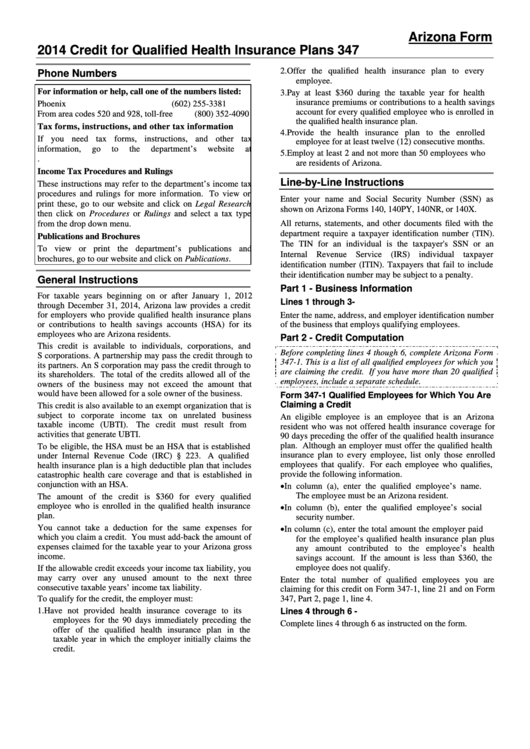

Arizona Form

2014 Credit for Qualified Health Insurance Plans

347

2. Offer the qualified health insurance plan to every

Phone Numbers

employee.

For information or help, call one of the numbers listed:

3. Pay at least $360 during the taxable year for health

insurance premiums or contributions to a health savings

Phoenix

(602) 255-3381

account for every qualified employee who is enrolled in

From area codes 520 and 928, toll-free

(800) 352-4090

the qualified health insurance plan.

Tax forms, instructions, and other tax information

4. Provide the health insurance plan to the enrolled

If you need tax forms, instructions, and other tax

employee for at least twelve (12) consecutive months.

information,

go

to

the

department’s

website

at

5. Employ at least 2 and not more than 50 employees who

are residents of Arizona.

Income Tax Procedures and Rulings

Line-by-Line Instructions

These instructions may refer to the department’s income tax

procedures and rulings for more information. To view or

Enter your name and Social Security Number (SSN) as

print these, go to our website and click on Legal Research

shown on Arizona Forms 140, 140PY, 140NR, or 140X.

then click on Procedures or Rulings and select a tax type

All returns, statements, and other documents filed with the

from the drop down menu.

department require a taxpayer identification number (TIN).

Publications and Brochures

The TIN for an individual is the taxpayer's SSN or an

To view or print the department’s publications and

Internal Revenue Service (IRS) individual taxpayer

brochures, go to our website and click on Publications.

identification number (ITIN). Taxpayers that fail to include

their identification number may be subject to a penalty.

General Instructions

Part 1 - Business Information

For taxable years beginning on or after January 1, 2012

Lines 1 through 3-

through December 31, 2014, Arizona law provides a credit

for employers who provide qualified health insurance plans

Enter the name, address, and employer identification number

or contributions to health savings accounts (HSA) for its

of the business that employs qualifying employees.

employees who are Arizona residents.

Part 2 - Credit Computation

This credit is available to individuals, corporations, and

Before completing lines 4 though 6, complete Arizona Form

S corporations. A partnership may pass the credit through to

347-1. This is a list of all qualified employees for which you

its partners. An S corporation may pass the credit through to

are claiming the credit. If you have more than 20 qualified

its shareholders. The total of the credits allowed all of the

employees, include a separate schedule.

owners of the business may not exceed the amount that

would have been allowed for a sole owner of the business.

Form 347-1 Qualified Employees for Which You Are

Claiming a Credit

This credit is also available to an exempt organization that is

subject to corporate income tax on unrelated business

An eligible employee is an employee that is an Arizona

taxable income (UBTI).

The credit must result from

resident who was not offered health insurance coverage for

activities that generate UBTI.

90 days preceding the offer of the qualified health insurance

plan. Although an employer must offer the qualified health

To be eligible, the HSA must be an HSA that is established

insurance plan to every employee, list only those enrolled

under Internal Revenue Code (IRC) § 223. A qualified

employees that qualify. For each employee who qualifies,

health insurance plan is a high deductible plan that includes

provide the following information.

catastrophic health care coverage and that is established in

conjunction with an HSA.

In column (a), enter the qualified employee’s name.

The employee must be an Arizona resident.

The amount of the credit is $360 for every qualified

employee who is enrolled in the qualified health insurance

In column (b), enter the qualified employee’s social

plan.

security number.

You cannot take a deduction for the same expenses for

In column (c), enter the total amount the employer paid

which you claim a credit. You must add-back the amount of

for the employee’s qualified health insurance plan plus

expenses claimed for the taxable year to your Arizona gross

any amount contributed to the employee’s health

income.

savings account. If the amount is less than $360, the

employee does not qualify.

If the allowable credit exceeds your income tax liability, you

may carry over any unused amount to the next three

Enter the total number of qualified employees you are

consecutive taxable years’ income tax liability.

claiming for this credit on Form 347-1, line 21 and on Form

347, Part 2, page 1, line 4.

To qualify for the credit, the employer must:

1. Have not provided health insurance coverage to its

Lines 4 through 6 -

employees for the 90 days immediately preceding the

Complete lines 4 through 6 as instructed on the form.

offer of the qualified health insurance plan in the

taxable year in which the employer initially claims the

credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2