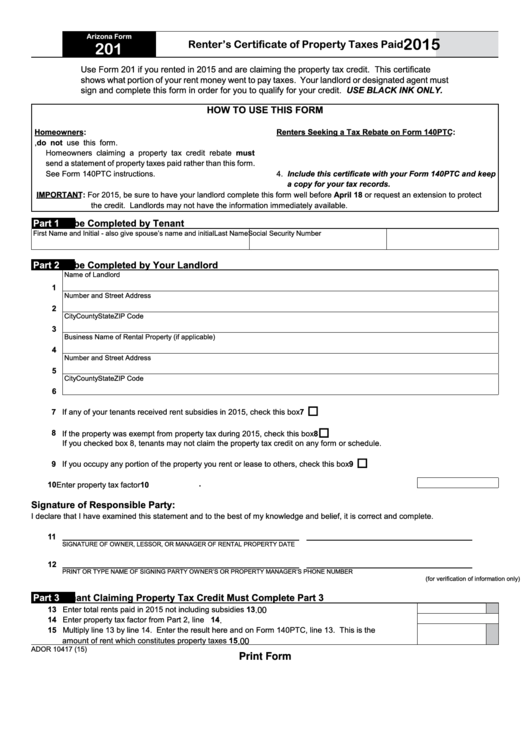

Arizona Form

2015

Renter’s Certificate of Property Taxes Paid

201

Use Form 201 if you rented in 2015 and are claiming the property tax credit. This certificate

shows what portion of your rent money went to pay taxes. Your landlord or designated agent must

sign and complete this form in order for you to qualify for your credit. USE BLACK INK ONLY.

HOW TO USE THIS FORM

Homeowners:

Renters Seeking a Tax Rebate on Form 140PTC:

1. If you own the home you live in, do not use this form.

1. Ask your landlord to complete Part 2 of this form.

Homeowners claiming a property tax credit rebate must

2. Complete Parts 1 and 3 if you qualify. See instructions.

send a statement of property taxes paid rather than this form.

3. Use this information to complete your Form 140PTC.

See Form 140PTC instructions.

4. Include this certificate with your Form 140PTC and keep

a copy for your tax records.

IMPORTANT: For 2015, be sure to have your landlord complete this form well before April 18 or request an extension to protect

the credit. Landlords may not have the information immediately available.

Part 1

To be Completed by Tenant

First Name and Initial - also give spouse’s name and initial

Last Name

Social Security Number

Part 2

To be Completed by Your Landlord

Name of Landlord

1

Number and Street Address

2

City

County

State

ZIP Code

3

Business Name of Rental Property (if applicable)

4

Number and Street Address

5

City

County

State

ZIP Code

6

7 If any of your tenants received rent subsidies in 2015, check this box ................................................ 7

8 If the property was exempt from property tax during 2015, check this box .......................................... 8

If you checked box 8, tenants may not claim the property tax credit on any form or schedule.

9 If you occupy any portion of the property you rent or lease to others, check this box .......................... 9

.

10 Enter property tax factor ....................................................................................................................... 10

Signature of Responsible Party:

I declare that I have examined this statement and to the best of my knowledge and belief, it is correct and complete.

11

SIGNATURE OF OWNER, LESSOR, OR MANAGER OF RENTAL PROPERTY

DATE

12

PRINT OR TYPE NAME OF SIGNING PARTY

OWNER’S OR PROPERTY MANAGER’S PHONE NUMBER

(for verification of information only)

Part 3

Tenant Claiming Property Tax Credit Must Complete Part 3

.00

13 Enter total rents paid in 2015 not including subsidies ......................................................................... 13

14 Enter property tax factor from Part 2, line 10....................................................................................... 14

.

15 Multiply line 13 by line 14. Enter the result here and on Form 140PTC, line 13. This is the

amount of rent which constitutes property taxes ................................................................................ 15

.00

ADOR 10417 (15)

Print Form

1

1