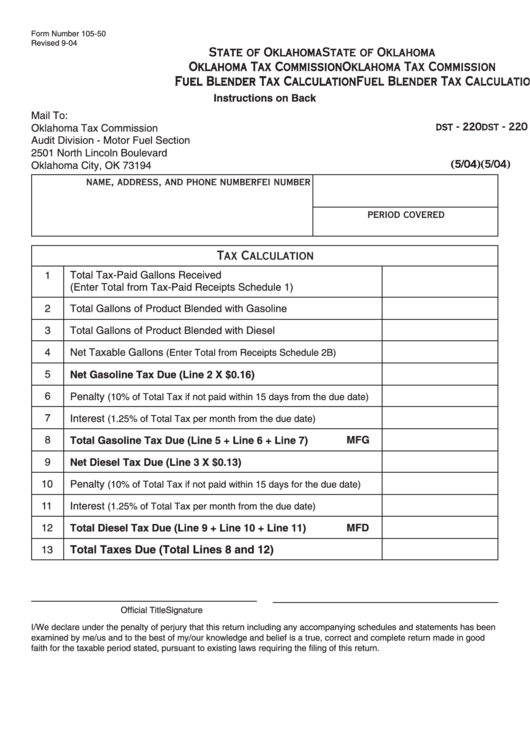

Form 105-50 - Fuel Blender Tax Calculation

ADVERTISEMENT

Form Number 105-50

Revised 9-04

State of Oklahoma

State of Oklahoma

State of Oklahoma

State of Oklahoma

State of Oklahoma

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Fuel Blender Tax Calculation

Fuel Blender Tax Calculation

Fuel Blender Tax Calculation

Fuel Blender Tax Calculation

Fuel Blender Tax Calculation

Instructions on Back

Mail To:

Oklahoma Tax Commission

dst - 220

dst - 220

dst - 220

dst - 220

dst - 220

Audit Division - Motor Fuel Section

2501 North Lincoln Boulevard

(5/04)

(5/04)

(5/04)

Oklahoma City, OK 73194

(5/04)

(5/04)

name, address, and phone number

fei number

period covered

Tax Calculation

Total Tax-Paid Gallons Received

1

(Enter Total from Tax-Paid Receipts Schedule 1)

2

Total Gallons of Product Blended with Gasoline

3

Total Gallons of Product Blended with Diesel

4

Net Taxable Gallons

(Enter Total from Receipts Schedule 2B)

5

Net Gasoline Tax Due (Line 2 X $0.16)

6

Penalty

(10% of Total Tax if not paid within 15 days from the due date)

7

Interest

(1.25% of Total Tax per month from the due date)

8

Total Gasoline Tax Due (Line 5 + Line 6 + Line 7)

MFG

9

Net Diesel Tax Due (Line 3 X $0.13)

10

Penalty

(10% of Total Tax if not paid within 15 days for the due date)

11

Interest

(1.25% of Total Tax per month from the due date)

12

Total Diesel Tax Due (Line 9 + Line 10 + Line 11)

MFD

Total Taxes Due (Total Lines 8 and 12)

13

Official Title

Signature

I/We declare under the penalty of perjury that this return including any accompanying schedules and statements has been

examined by me/us and to the best of my/our knowledge and belief is a true, correct and complete return made in good

faith for the taxable period stated, pursuant to existing laws requiring the filing of this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2