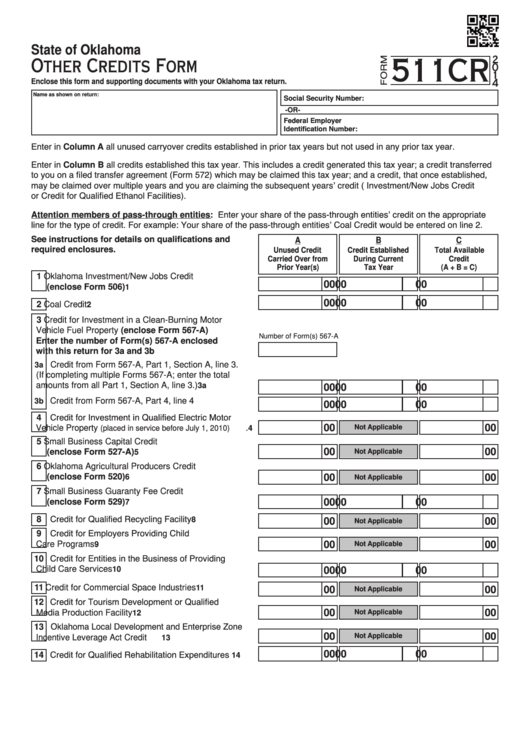

State of Oklahoma

511CR

2

Other Credits Form

0

1

4

Enclose this form and supporting documents with your Oklahoma tax return.

Name as shown on return:

Social Security Number:

-OR-

Federal Employer

Identification Number:

Enter in Column A all unused carryover credits established in prior tax years but not used in any prior tax year.

Enter in Column B all credits established this tax year. This includes a credit generated this tax year; a credit transferred

to you on a filed transfer agreement (Form 572) which may be claimed this tax year; and a credit, that once established,

may be claimed over multiple years and you are claiming the subsequent years’ credit (e.g. Investment/New Jobs Credit

or Credit for Qualified Ethanol Facilities).

Attention members of pass-through entities: Enter your share of the pass-through entities’ credit on the appropriate

line for the type of credit. For example: Your share of the pass-through entities’ Coal Credit would be entered on line 2.

See instructions for details on qualifications and

A

B

C

required enclosures.

Unused Credit

Credit Established

Total Available

Carried Over from

During Current

Credit

Prior Year(s)

Tax Year

(A + B = C)

1 Oklahoma Investment/New Jobs Credit

00

00

00

(enclose Form 506) .................................................

1

00

00

00

2 Coal Credit ................................................................

2

3 Credit for Investment in a Clean-Burning Motor

Vehicle Fuel Property (enclose Form 567-A)

Number of Form(s) 567-A

Enter the number of Form(s) 567-A enclosed

with this return for 3a and 3b ..................................

Credit from Form 567-A, Part 1, Section A, line 3.

3a

(If completing multiple Forms 567-A; enter the total

amounts from all Part 1, Section A, line 3.)

.............. 3a

00

00

00

Credit from Form 567-A, Part 4, line 4

3b

......................3b

00

00

00

4 Credit for Investment in Qualified Electric Motor

00

00

Not Applicable

Vehicle Property

.

(placed in service before July 1, 2010)

4

5 Small Business Capital Credit

00

00

Not Applicable

(enclose Form 527-A) .............................................

5

6 Oklahoma Agricultural Producers Credit

(enclose Form 520) .................................................

6

00

00

Not Applicable

7 Small Business Guaranty Fee Credit

00

00

00

(enclose Form 529) .................................................

7

8 Credit for Qualified Recycling Facility .......................

8

00

00

Not Applicable

9 Credit for Employers Providing Child

Care Programs .........................................................

00

Not Applicable

00

9

10 Credit for Entities in the Business of Providing

Child Care Services ................................................

10

00

00

00

11 Credit for Commercial Space Industries .................

11

00

00

Not Applicable

12 Credit for Tourism Development or Qualified

00

00

Media Production Facility .......................................

Not Applicable

12

13 Oklahoma Local Development and Enterprise Zone

00

00

Not Applicable

Incentive Leverage Act Credit ..................................

13

14 Credit for Qualified Rehabilitation Expenditures ....

00

00

00

14

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8