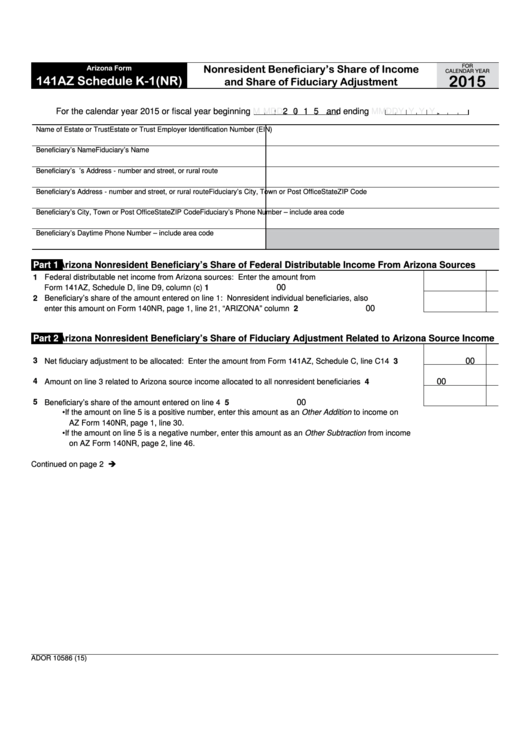

FOR

Nonresident Beneficiary’s Share of Income

Arizona Form

CALENDAR YEAR

2015

141AZ Schedule K-1(NR)

and Share of Fiduciary Adjustment

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

Name of Estate or Trust

Estate or Trust Employer Identification Number (EIN)

Beneficiary’s Name

Fiduciary’s Name

Beneficiary’s I.D. Number

Fiduciary’s Address - number and street, or rural route

Beneficiary’s Address - number and street, or rural route

Fiduciary’s City, Town or Post Office

State

ZIP Code

Beneficiary’s City, Town or Post Office

State

ZIP Code

Fiduciary’s Phone Number – include area code

Beneficiary’s Daytime Phone Number – include area code

Part 1

Arizona Nonresident Beneficiary’s Share of Federal Distributable Income From Arizona Sources

1 Federal distributable net income from Arizona sources: Enter the amount from

00

Form 141AZ, Schedule D, line D9, column (c)................................................................................................. 1

2 Beneficiary’s share of the amount entered on line 1: Nonresident individual beneficiaries, also

00

enter this amount on Form 140NR, page 1, line 21, “ARIZONA” column ........................................................ 2

Part 2

Arizona Nonresident Beneficiary’s Share of Fiduciary Adjustment Related to Arizona Source Income

00

3 Net fiduciary adjustment to be allocated: Enter the amount from Form 141AZ, Schedule C, line C14 .......... 3

00

4 Amount on line 3 related to Arizona source income allocated to all nonresident beneficiaries ........................ 4

00

5 Beneficiary’s share of the amount entered on line 4 ........................................................................................ 5

• If the amount on line 5 is a positive number, enter this amount as an Other Addition to income on

AZ Form 140NR, page 1, line 30.

• If the amount on line 5 is a negative number, enter this amount as an Other Subtraction from income

on AZ Form 140NR, page 2, line 46.

Continued on page 2

ADOR 10586 (15)

1

1 2

2 3

3