View Instructions

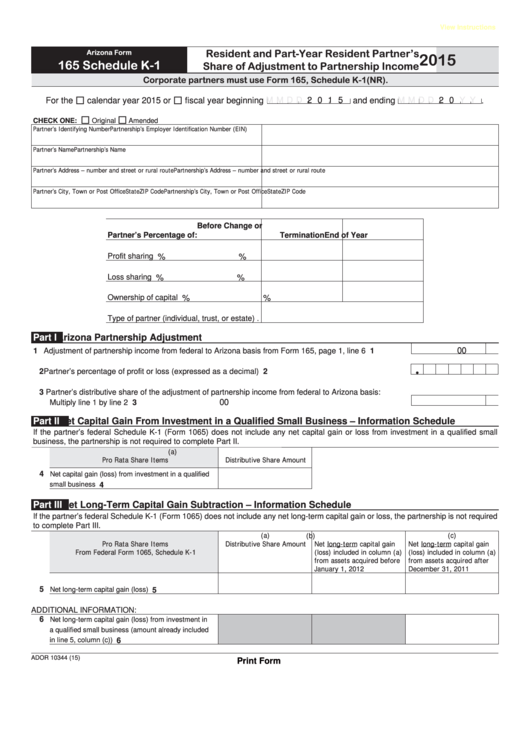

Resident and Part-Year Resident Partner’s

Arizona Form

2015

165 Schedule K-1

Share of Adjustment to Partnership Income

Corporate partners must use Form 165, Schedule K-1(NR).

For the

calendar year 2015 or

fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D

2 0

Y Y

.

CHECK ONE:

Original

Amended

Partner’s Identifying Number

Partnership’s Employer Identification Number (EIN)

Partner’s Name

Partnership’s Name

Partner’s Address – number and street or rural route

Partnership’s Address – number and street or rural route

Partner’s City, Town or Post Office

State ZIP Code

Partnership’s City, Town or Post Office

State ZIP Code

Before Change or

Partner’s Percentage of:

Termination

End of Year

Profit sharing ...............................................

%

%

Loss sharing ................................................

%

%

Ownership of capital ....................................

%

%

Type of partner (individual, trust, or estate) .

Part I

Arizona Partnership Adjustment

00

1 Adjustment of partnership income from federal to Arizona basis from Form 165, page 1, line 6 ......... 1

2 Partner’s percentage of profit or loss (expressed as a decimal) ........................................................... 2

3 Partner’s distributive share of the adjustment of partnership income from federal to Arizona basis:

00

Multiply line 1 by line 2 .......................................................................................................................... 3

Part II

Net Capital Gain From Investment in a Qualified Small Business – Information Schedule

If the partner’s federal Schedule K-1 (Form 1065) does not include any net capital gain or loss from investment in a qualified small

business, the partnership is not required to complete Part II.

(a)

Pro Rata Share Items

Distributive Share Amount

4

Net capital gain (loss) from investment in a qualified

small business .........................................................

4

Part III

Net Long-Term Capital Gain Subtraction – Information Schedule

If the partner’s federal Schedule K-1 (Form 1065) does not include any net long-term capital gain or loss, the partnership is not required

to complete Part III.

(a)

(b)

(c)

Pro Rata Share Items

Distributive Share Amount

Net long-term capital gain

Net long-term capital gain

From Federal Form 1065, Schedule K-1

(loss) included in column (a)

(loss) included in column (a)

from assets acquired before

from assets acquired after

January 1, 2012

December 31, 2011

5

Net long-term capital gain (loss) ..............................

5

ADDITIONAL INFORMATION:

6

Net long-term capital gain (loss) from investment in

a qualified small business (amount already included

in line 5, column (c)) ................................................

6

ADOR 10344 (15)

Print Form

1

1 2

2