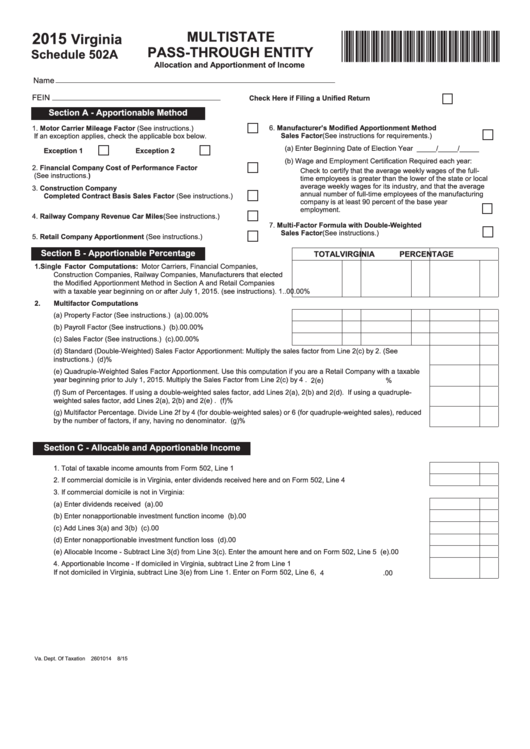

Multistate

2015

Virginia

*VA502A115888*

Pass-tHROuGH entity

schedule 502a

allocation and apportionment of income

Name

FEIN

Check Here if Filing a unified Return .....................................

section a - apportionable Method

6. Manufacturer’s Modified apportionment Method

1. Motor Carrier Mileage Factor (See instructions.) .........................

sales Factor (See instructions for requirements.) .........................

If an exception applies, check the applicable box below.

(a) Enter Beginning Date of Election Year

_____/_____/_____

exception 1

exception 2

(b) Wage and Employment Certification Required each year:

2. Financial Company Cost of Performance Factor .......................

Check to certify that the average weekly wages of the full-

(See instructions.)

time employees is greater than the lower of the state or local

average weekly wages for its industry, and that the average

3. Construction Company

annual number of full-time employees of the manufacturing

Completed Contract Basis sales Factor (See instructions.) .......

company is at least 90 percent of the base year

employment. .........................................................................

4. Railway Company Revenue Car Miles (See instructions.) ...........

7. Multi-Factor Formula with Double-Weighted

sales Factor (See instructions.) .....................................................

5. Retail Company apportionment (See instructions.) .....................

section B - apportionable Percentage

tOtal

ViRGinia

PeRCentaGe

1.

single Factor Computations: Motor Carriers, Financial Companies,

Construction Companies, Railway Companies, Manufacturers that elected

the Modified Apportionment Method in Section A and Retail Companies

with a taxable year beginning on or after July 1, 2015. (see instructions).

1.

.00

.00

%

2.

Multifactor Computations

(a) Property Factor (See instructions.) ..................................................

2(a)

.00

.00

%

(b) Payroll Factor (See instructions.) .....................................................

2(b)

.00

.00

%

(c) Sales Factor (See instructions.) .......................................................

2(c)

.00

.00

%

(d) Standard (Double-Weighted) Sales Factor Apportionment: Multiply the sales factor from Line 2(c) by 2. (See

instructions.) ................................................................................................................................................................... 2(d)

%

(e) Quadruple-Weighted Sales Factor Apportionment. Use this computation if you are a Retail Company with a taxable

year beginning prior to July 1, 2015. Multiply the Sales Factor from Line 2(c) by 4 . ..................................................... 2(e)

%

(f) Sum of Percentages. If using a double-weighted sales factor, add Lines 2(a), 2(b) and 2(d). If using a quadruple-

weighted sales factor, add Lines 2(a), 2(b) and 2(e) . ....................................................................................................

2(f)

%

(g) Multifactor Percentage. Divide Line 2f by 4 (for double-weighted sales) or 6 (for quadruple-weighted sales), reduced

by the number of factors, if any, having no denominator. ..............................................................................................

2(g)

%

section C - allocable and apportionable income

1. Total of taxable income amounts from Form 502, Line 1 ............................................................................................

1

.00

2. If commercial domicile is in Virginia, enter dividends received here and on Form 502, Line 4 ..................................

2

.00

3. If commercial domicile is not in Virginia:

(a) Enter dividends received ........................................................................................................................................ 3(a)

.00

(b) Enter nonapportionable investment function income ............................................................................................. 3(b)

.00

(c) Add Lines 3(a) and 3(b) .......................................................................................................................................... 3(c)

.00

(d) Enter nonapportionable investment function loss ................................................................................................... 3(d)

.00

(e) Allocable Income - Subtract Line 3(d) from Line 3(c). Enter the amount here and on Form 502, Line 5 ............... 3(e)

.00

4. Apportionable Income - If domiciled in Virginia, subtract Line 2 from Line 1

If not domiciled in Virginia, subtract Line 3(e) from Line 1. Enter on Form 502, Line 6, ........

4

.00

Va. Dept. Of Taxation

2601014

8 / 15

1

1