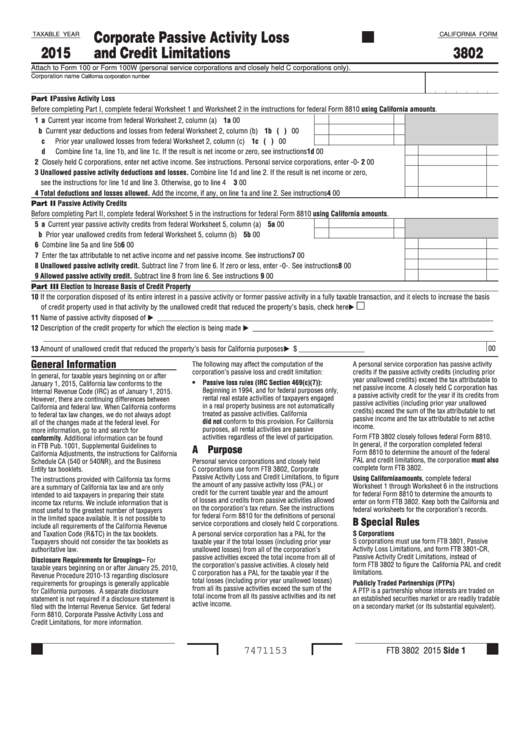

Corporate Passive Activity Loss

TAXABLE YEAR

CALIFORNIA FORM

2015

and Credit Limitations

3802

Attach to Form 100 or Form 100W (personal service corporations and closely held C corporations only).

Corporation name

California corporation number

Part I Passive Activity Loss

Before completing Part I, complete federal Worksheet 1 and Worksheet 2 in the instructions for federal Form 8810 using California amounts.

1 a Current year income from federal Worksheet 2, column (a) . . . . . . . . . . . . . . . . . . . . . . . . 1a

00

b Current year deductions and losses from federal Worksheet 2, column (b) . . . . . . . . . . . . 1b (

) 00

c Prior year unallowed losses from federal Worksheet 2, column (c). . . . . . . . . . . . . . . . . . .

1c (

) 00

d Combine line 1a, line 1b, and line 1c. If the result is net income or zero, see instructions . . . . . . . . . . . . . . . . . . . . . . . . .

1d

00

2 Closely held C corporations, enter net active income. See instructions. Personal service corporations, enter -0- . . . . . . . . . .

2

00

3 Unallowed passive activity deductions and losses. Combine line 1d and line 2. If the result is net income or zero,

see the instructions for line 1d and line 3. Otherwise, go to line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Total deductions and losses allowed. Add the income, if any, on line 1a and line 2. See instructions . . . . . . . . . . . . . . . . . .

4

00

Part II Passive Activity Credits

Before completing Part II, complete federal Worksheet 5 in the instructions for federal Form 8810 using California amounts.

5 a Current year passive activity credits from federal Worksheet 5, column (a) . . . . . . . . . . . . 5a

00

b Prior year unallowed credits from federal Worksheet 5, column (b) . . . . . . . . . . . . . . . . . . 5b

00

6 Combine line 5a and line 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Enter the tax attributable to net active income and net passive income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Unallowed passive activity credit. Subtract line 7 from line 6. If zero or less, enter -0-. See instructions . . . . . . . . . . . . . . .

8

00

9 Allowed passive activity credit. Subtract line 8 from line 6. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

Part III Election to Increase Basis of Credit Property

10 If the corporation disposed of its entire interest in a passive activity or former passive activity in a fully taxable transaction, and it elects to increase the basis

of credit property used in that activity by the unallowed credit that reduced the property’s basis, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Name of passive activity disposed of ____________________________________________________________________________________________

12 Description of the credit property for which the election is being made __________________________________________________________________

____________________________________________________________________________________________________________________________

00

13 Amount of unallowed credit that reduced the property’s basis for California purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ __________________

General Information

A personal service corporation has passive activity

The following may affect the computation of the

corporation’s passive loss and credit limitation:

credits if the passive activity credits (including prior

In general, for taxable years beginning on or after

year unallowed credits) exceed the tax attributable to

•

Passive loss rules (IRC Section 469(c)(7)):

January 1, 2015, California law conforms to the

net passive income. A closely held C corporation has

Beginning in 1994, and for federal purposes only,

Internal Revenue Code (IRC) as of January 1, 2015.

a passive activity credit for the year if its credits from

rental real estate activities of taxpayers engaged

However, there are continuing differences between

passive activities (including prior year unallowed

in a real property business are not automatically

California and federal law. When California conforms

credits) exceed the sum of the tax attributable to net

treated as passive activities. California

to federal tax law changes, we do not always adopt

passive income and the tax attributable to net active

did not conform to this provision. For California

all of the changes made at the federal level. For

income.

purposes, all rental activities are passive

more information, go to ftb.ca.gov and search for

Form FTB 3802 closely follows federal Form 8810.

activities regardless of the level of participation.

conformity. Additional information can be found

In general, if the corporation completed federal

in FTB Pub. 1001, Supplemental Guidelines to

A Purpose

Form 8810 to determine the amount of the federal

California Adjustments, the instructions for California

PAL and credit limitations, the corporation must also

Schedule CA (540 or 540NR), and the Business

Personal service corporations and closely held

complete form FTB 3802.

Entity tax booklets.

C corporations use form FTB 3802, Corporate

Passive Activity Loss and Credit Limitations, to figure

Using California amounts, complete federal

The instructions provided with California tax forms

the amount of any passive activity loss (PAL) or

Worksheet 1 through Worksheet 6 in the instructions

are a summary of California tax law and are only

credit for the current taxable year and the amount

for federal Form 8810 to determine the amounts to

intended to aid taxpayers in preparing their state

of losses and credits from passive activities allowed

enter on form FTB 3802. Keep both the California and

income tax returns. We include information that is

on the corporation’s tax return. See the instructions

federal worksheets for the corporation’s records.

most useful to the greatest number of taxpayers

for federal Form 8810 for the definitions of personal

in the limited space available. It is not possible to

B Special Rules

service corporations and closely held C corporations.

include all requirements of the California Revenue

S Corporations

and Taxation Code (R&TC) in the tax booklets.

A personal service corporation has a PAL for the

taxable year if the total losses (including prior year

S corporations must use form FTB 3801, Passive

Taxpayers should not consider the tax booklets as

Activity Loss Limitations, and form FTB 3801-CR,

authoritative law.

unallowed losses) from all of the corporation’s

passive activities exceed the total income from all of

Passive Activity Credit Limitations, instead of

Disclosure Requirements for Groupings – For

the corporation’s passive activities. A closely held

form FTB 3802 to figure the California PAL and credit

taxable years beginning on or after January 25, 2010,

C corporation has a PAL for the taxable year if the

limitations.

Revenue Procedure 2010-13 regarding disclosure

total losses (including prior year unallowed losses)

Publicly Traded Partnerships (PTPs)

requirements for groupings is generally applicable

from all its passive activities exceed the sum of the

A PTP is a partnership whose interests are traded on

for California purposes. A separate disclosure

total income from all its passive activities and its net

an established securities market or are readily tradable

statement is not required if a disclosure statement is

active income.

on a secondary market (or its substantial equivalent).

filed with the Internal Revenue Service. Get federal

Form 8810, Corporate Passive Activity Loss and

Credit Limitations, for more information.

FTB 3802 2015 Side 1

7471153

1

1 2

2