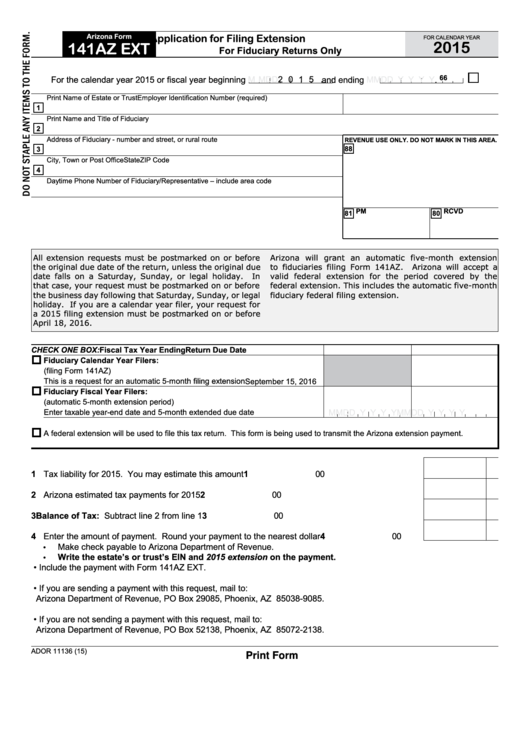

Arizona Form

Application for Filing Extension

FOR CALENDAR YEAR

2015

141AZ EXT

For Fiduciary Returns Only

66

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

Print Name of Estate or Trust

Employer Identification Number (required)

1

Print Name and Title of Fiduciary

2

Address of Fiduciary - number and street, or rural route

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

3

City, Town or Post Office

State

ZIP Code

4

Daytime Phone Number of Fiduciary/Representative – include area code

81 PM

80 RCVD

All extension requests must be postmarked on or before

Arizona will grant an automatic five-month extension

the original due date of the return, unless the original due

to fiduciaries filing Form 141AZ.

Arizona will accept a

date falls on a Saturday, Sunday, or legal holiday.

In

valid federal extension for the period covered by the

that case, your request must be postmarked on or before

federal extension. This includes the automatic five-month

the business day following that Saturday, Sunday, or legal

fiduciary federal filing extension.

holiday. If you are a calendar year filer, your request for

a 2015 filing extension must be postmarked on or before

April 18, 2016.

CHECK ONE BOX:

Fiscal Tax Year Ending

Return Due Date

Fiduciary Calendar Year Filers:

(filing Form 141AZ)

This is a request for an automatic 5-month filing extension ..................................

September 15, 2016

Fiduciary Fiscal Year Filers:

(automatic 5-month extension period)

Enter taxable year-end date and 5-month extended due date ..............................

M M D D Y Y Y Y M M D D Y Y Y Y

A federal extension will be used to file this tax return. This form is being used to transmit the Arizona extension payment.

1 Tax liability for 2015. You may estimate this amount ..................................................................... 1

00

2 Arizona estimated tax payments for 2015 ...................................................................................... 2

00

3 Balance of Tax: Subtract line 2 from line 1 .................................................................................. 3

00

4 Enter the amount of payment. Round your payment to the nearest dollar .................................... 4

00

Make check payable to Arizona Department of Revenue.

•

Write the estate’s or trust’s EIN and 2015 extension on the payment.

•

• Include the payment with Form 141AZ EXT.

• If you are sending a payment with this request, mail to:

Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

• If you are not sending a payment with this request, mail to:

Arizona Department of Revenue, PO Box 52138, Phoenix, AZ 85072-2138.

ADOR 11136 (15)

Print Form

1

1