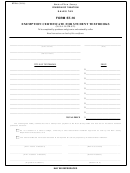

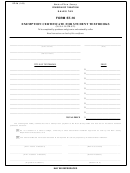

INSTRUCTIONS TO SELLERS CONCERNING

EXEMPTION CERTIFICATE FOR STUDENT TEXTBOOKS

Receipts from the sales of textbooks, for use by students, are exempt under Section 8.21 of the Sales Tax

Act (reproduced below). The educational institution should prescribe through its academic departments the

particular books that are required for school purposes. This form ST-16 should be completed by the student

purchasing the exempt textbook and retained by the bookstore.

You may accept this certificate as a basis for exempting sales of textbooks to the purchaser providing

he has:

a. properly completed this form; and,

b. presented valid proof of his enrollment in a school, college, university or other educational

institution approved as such by the New Jersey Department of Education.

N.J.S.A. 54:32B-8.21 of the New Jersey Sales and Use Tax Act exempts the following:

“Sales of school textbooks for use by students in a school, college, university or other educational

institution, approved as such by the Department of Education, when the educational institution, upon forms

and pursuant to regulations prescribed by the director, has declared the books are required for school

purposes and the purchaser has supplied the seller with the form at the time of the sale.”

For the purposes of the school textbook exemption, “textbook” means any book which the educational

institution requires students to purchase for use in one of its courses.

IMPORTANT NOTE:

This certificate (Form ST-16) must be retained by the seller for auditing

purposes.

REPRODUCTION OF FORM

This certificate may be reproduced without permission of the Director, Division of Taxation, so long as the

text and format are unchanged. It is expected that many sellers will want to have this certificate reproduced

for their own convenience, as well as for the convenience of their customer’s.

FOR MORE INFORMATION: Read publication S&U-6 (Sales Tax Exemption Administration) at

DO NOT MAIL THIS FORM TO THE DIVISION OF TAXATION

This form is to be completed by purchaser and given to and retained by seller.

1

1 2

2