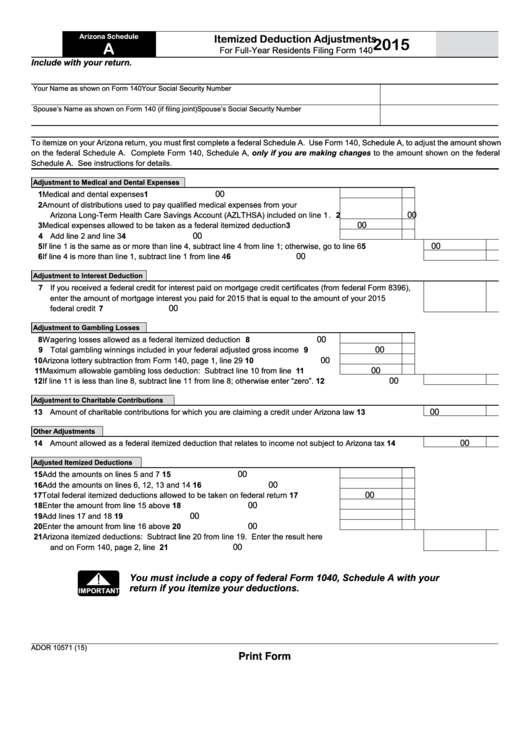

Arizona Schedule

Itemized Deduction Adjustments

2015

A

For Full-Year Residents Filing Form 140

Include with your return.

Your Name as shown on Form 140

Your Social Security Number

Spouse’s Name as shown on Form 140 (if filing joint)

Spouse’s Social Security Number

To itemize on your Arizona return, you must first complete a federal Schedule A. Use Form 140, Schedule A, to adjust the amount shown

on the federal Schedule A. Complete Form 140, Schedule A, only if you are making changes to the amount shown on the federal

Schedule A. See instructions for details.

Adjustment to Medical and Dental Expenses

00

1 Medical and dental expenses ................................................................................. 1

2 Amount of distributions used to pay qualified medical expenses from your

00

Arizona Long-Term Health Care Savings Account (AZLTHSA) included on line 1 . 2

00

3 Medical expenses allowed to be taken as a federal itemized deduction ................ 3

00

4 Add line 2 and line 3 ............................................................................................... 4

00

5 If line 1 is the same as or more than line 4, subtract line 4 from line 1; otherwise, go to line 6 .................... 5

00

6 If line 4 is more than line 1, subtract line 1 from line 4 .................................................................................. 6

Adjustment to Interest Deduction

7 If you received a federal credit for interest paid on mortgage credit certificates (from federal Form 8396),

enter the amount of mortgage interest you paid for 2015 that is equal to the amount of your 2015

00

federal credit .................................................................................................................................................. 7

Adjustment to Gambling Losses

00

8 Wagering losses allowed as a federal itemized deduction ..................................... 8

00

9 Total gambling winnings included in your federal adjusted gross income .............. 9

00

10 Arizona lottery subtraction from Form 140, page 1, line 29 .................................... 10

00

11 Maximum allowable gambling loss deduction: Subtract line 10 from line 9........... 11

00

12 If line 11 is less than line 8, subtract line 11 from line 8; otherwise enter “zero”. ........................................... 12

Adjustment to Charitable Contributions

00

13 Amount of charitable contributions for which you are claiming a credit under Arizona law ........................... 13

Other Adjustments

00

14 Amount allowed as a federal itemized deduction that relates to income not subject to Arizona tax ............. 14

Adjusted Itemized Deductions

00

15 Add the amounts on lines 5 and 7 .......................................................................... 15

00

16 Add the amounts on lines 6, 12, 13 and 14 ............................................................ 16

00

17 Total federal itemized deductions allowed to be taken on federal return ................ 17

00

18 Enter the amount from line 15 above ..................................................................... 18

00

19 Add lines 17 and 18 ................................................................................................ 19

00

20 Enter the amount from line 16 above ..................................................................... 20

21 Arizona itemized deductions: Subtract line 20 from line 19. Enter the result here

00

and on Form 140, page 2, line 43.................................................................................................................. 21

!

You must include a copy of federal Form 1040, Schedule A with your

return if you itemize your deductions.

IMPORTANT

ADOR 10571 (15)

Print Form

1

1