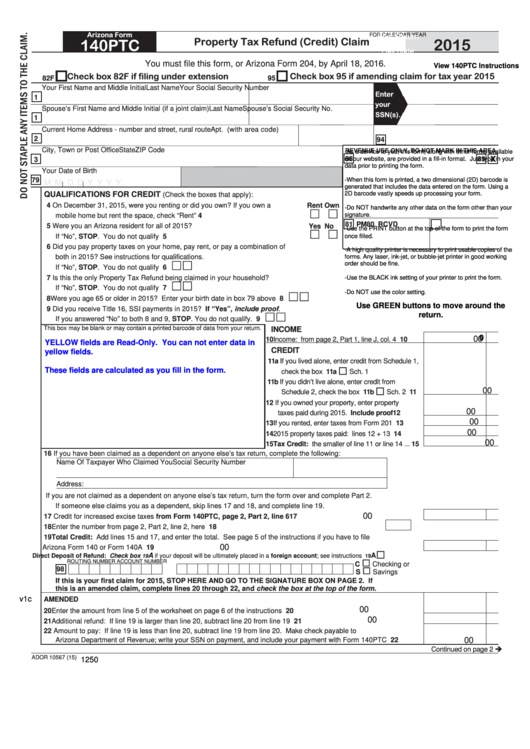

Arizona Form

FOR CALENDAR YEAR

Print Return

Property Tax Refund (Credit) Claim

2015

140PTC

Calculate

You must file this form, or Arizona Form 204, by April 18, 2016.

Reset

View 140PTC Instructions

Check box 82F if filing under extension

Check box 95 if amending claim for tax year 2015

82F

95

Your First Name and Middle Initial

Last Name

Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if a joint claim)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

-As a service to you, this form, along with other forms available

x

88

on our website, are provided in a fill-in format. Just type in your

3

89

data prior to printing the form.

Your Date of Birth

79

-When this form is printed, a two dimensional (2D) barcode is

M M D D Y Y Y Y

generated that includes the data entered on the form. Using a

QUALIFICATIONS FOR CREDIT

2D barcode vastly speeds up processing your form.

(Check the boxes that apply):

4 On December 31, 2015, were you renting or did you own? If you own a

Rent Own

-Do NOT handwrite any other data on the form other than your

signature.

mobile home but rent the space, check “Rent”.................................................... 4

81 PM

80 RCVD

5 Were you an Arizona resident for all of 2015?

Yes

No

-Use the PRINT button at the top of the form to print the form

If “No”, STOP. You do not qualify ....................................................................... 5

once filled.

6 Did you pay property taxes on your home, pay rent, or pay a combination of

-A high quality printer is necessary to print usable copies of the

both in 2015? See instructions for qualifications.

forms. Any laser, ink-jet, or bubble-jet printer in good working

order should be fine.

If “No”, STOP. You do not qualify ....................................................................... 6

7 Is this the only Property Tax Refund being claimed in your household?

-Use the BLACK ink setting of your printer to print the form.

If “No”, STOP. You do not qualify ....................................................................... 7

-Do NOT use the color setting.

8 Were you age 65 or older in 2015? Enter your birth date in box 79 above ........ 8

Use GREEN buttons to move around the

9 Did you receive Title 16, SSI payments in 2015? If “Yes”, include proof.

return.

If you answered “No” to both 8 and 9, STOP. You do not qualify. ....................... 9

Go to Income: Page 2 Part I

This box may be blank or may contain a printed barcode of data from your return

.

INCOME

0

00

10 Income: from page 2, Part 1, line J, col. 4 ...... 10

YELLOW fields are Read-Only. You can not enter data in

CREDIT

yellow fields.

11a If you lived alone, enter credit from Schedule 1,

These fields are calculated as you fill in the form.

check the box .........................11a

Sch. 1

11b If you didn’t live alone, enter credit from

00

Schedule 2, check the box .....11b

Sch. 2 11

12 If you owned your property, enter property

00

taxes paid during 2015. Include proof .......... 12

00

13 If you rented, enter taxes from Form 201 ........ 13

00

14 2015 property taxes paid: lines 12 + 13 ......... 14

00

15 Tax Credit: the smaller of line 11 or line 14 ... 15

16 If you have been claimed as a dependent on anyone else’s tax return, complete the following:

Name Of Taxpayer Who Claimed You

Social Security Number

Address:

If you are not claimed as a dependent on anyone else’s tax return, turn the form over and complete Part 2.

Go to Page 2 Part II

If someone else claims you as a dependent, skip lines 17 and 18, and complete line 19.

00

17 Credit for increased excise taxes from Form 140PTC, page 2, Part 2, line 6 .............................................................. 17

18 Enter the number from page 2, Part 2, line 2, here ...................................................................................... 18

19 Total Credit: Add lines 15 and 17, and enter the total. See page 5 of the instructions if you have to file

00

Arizona Form 140 or Form 140A .................................................................................................................................... 19

A

A

Direct Deposit of Refund: Check box

if your deposit will be ultimately placed in a foreign account; see instructions ....

19

19

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

If this is your first claim for 2015, STOP HERE AND GO TO THE SIGNATURE BOX ON PAGE 2. If

this is an amended claim, complete lines 20 through 22, and check the box at the top of the form.

v1c

AMENDED

00

20 Enter the amount from line 5 of the worksheet on page 6 of the instructions ................................................................. 20

00

21 Additional refund: If line 19 is larger than line 20, subtract line 20 from line 19 ............................................................. 21

22 Amount to pay: If line 19 is less than line 20, subtract line 19 from line 20. Make check payable to

Arizona Department of Revenue; write your SSN on payment, and include your payment with Form 140PTC ............. 22

00

Continued on page 2

ADOR 10567 (15)

1250

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9