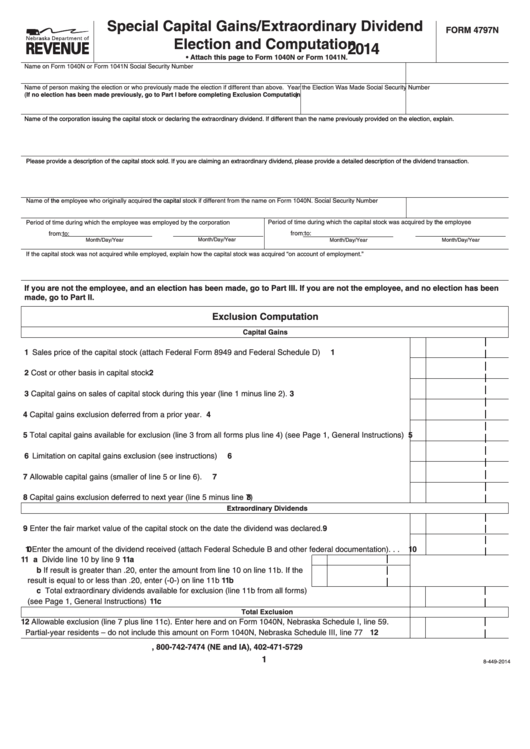

Special Capital Gains/Extraordinary Dividend

FORM 4797N

Election and Computation

2014

• Attach this page to Form 1040N or Form 1041N.

Name on Form 1040N or Form 1041N

Social Security Number

Name of person making the election or who previously made the election if different than above .

Year the Election Was Made

Social Security Number

(If no election has been made previously, go to Part I before completing Exclusion Computation.)

Name of the corporation issuing the capital stock or declaring the extraordinary dividend . If different than the name previously provided on the election, explain .

Please provide a description of the capital stock sold . If you are claiming an extraordinary dividend, please provide a detailed description of the dividend transaction .

Name of

the

employee who originally acquired

the capital

stock if different from the name on Form 1040N .

Social Security Number

Period of time during which the capital stock was acquired by

the

employee

Period of time during which the employee was employed by the corporation

from:

to:

from:

to:

Month/Day/Year

Month/Day/Year

Month/Day/Year

Month/Day/Year

If the capital stock was not acquired while employed, explain how the capital stock was acquired “on account of employment . ”

If you are not the employee, and an election has been made, go to Part III. If you are not the employee, and no election has been

made, go to Part II.

Exclusion Computation

Capital Gains

1 Sales price of the capital stock (attach Federal Form 8949 and Federal Schedule D) . . . . . . . . . . . . . . . . . . .

1

2 Cost or other basis in capital stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Capital gains on sales of capital stock during this year (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Capital gains exclusion deferred from a prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Total capital gains available for exclusion (line 3 from all forms plus line 4) (see Page 1, General Instructions)

5

6 Limitation on capital gains exclusion (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Allowable capital gains (smaller of line 5 or line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Capital gains exclusion deferred to next year (line 5 minus line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Extraordinary Dividends

9 Enter the fair market value of the capital stock on the date the dividend was declared . . . . . . . . . . . . . . . . . . .

9

10 Enter the amount of the dividend received (attach Federal Schedule B and other federal documentation) . . .

10

11 a Divide line 10 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11a

b If result is greater than .20, enter the amount from line 10 on line 11b . If the

result is equal to or less than .20, enter (-0-) on line 11b . . . . . . . . . . . . . . . . . . 11b

c Total extraordinary dividends available for exclusion (line 11b from all forms)

(see Page 1, General Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11c

Total Exclusion

12 Allowable exclusion (line 7 plus line 11c) . Enter here and on Form 1040N, Nebraska Schedule I, line 59 .

12

Partial-year residents – do not include this amount on Form 1040N, Nebraska Schedule III, line 77 . . . . . . . .

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

1

8-449-2014

1

1 2

2 3

3 4

4 5

5 6

6