Instructions For Form 341 - Credit For Corporate Contributions To School Tuition Organizations For Displaced Students Or Students With Disabilities - 2014

ADVERTISEMENT

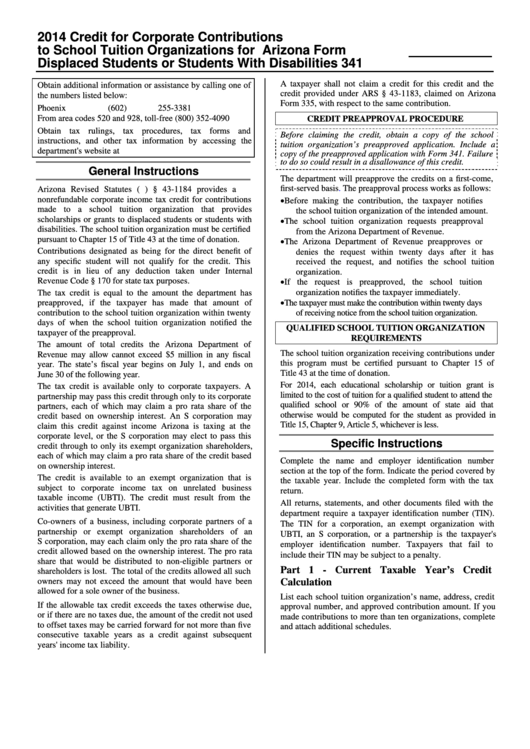

2014 Credit for Corporate Contributions

to School Tuition Organizations for

Arizona Form

Displaced Students or Students With Disabilities

341

A taxpayer shall not claim a credit for this credit and the

Obtain additional information or assistance by calling one of

credit provided under ARS § 43-1183, claimed on Arizona

the numbers listed below:

Form 335, with respect to the same contribution.

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

CREDIT PREAPPROVAL PROCEDURE

Obtain tax rulings, tax procedures, tax forms and

Before claiming the credit, obtain a copy of the school

instructions, and other tax information by accessing the

tuition organization’s preapproved application. Include a

department's website at

copy of the preapproved application with Form 341. Failure

to do so could result in a disallowance of this credit.

General Instructions

The department will preapprove the credits on a first-come,

first-served

basis.

The preapproval process works as follows:

Arizona Revised Statutes (A.R.S.) § 43-1184 provides a

nonrefundable corporate income tax credit for contributions

Before making the contribution, the taxpayer notifies

made to a school tuition organization that provides

the school tuition organization of the intended amount.

scholarships or grants to displaced students or students with

The school tuition organization requests preapproval

disabilities. The school tuition organization must be certified

from the Arizona Department of Revenue.

pursuant to Chapter 15 of Title 43 at the time of donation.

The Arizona Department of Revenue preapproves or

Contributions designated as being for the direct benefit of

denies the request within twenty days after it has

any specific student will not qualify for the credit. This

received the request, and notifies the school tuition

credit is in lieu of any deduction taken under Internal

organization.

Revenue Code § 170 for state tax purposes.

If the request is preapproved, the school tuition

organization notifies the taxpayer immediately.

The tax credit is equal to the amount the department has

preapproved, if the taxpayer has made that amount of

The taxpayer must make the contribution within twenty days

contribution to the school tuition organization within twenty

of receiving notice from the school tuition organization.

days of when the school tuition organization notified the

QUALIFIED SCHOOL TUITION ORGANIZATION

taxpayer of the preapproval.

REQUIREMENTS

The amount of total credits the Arizona Department of

The school tuition organization receiving contributions under

Revenue may allow cannot exceed $5 million in any fiscal

this program must be certified pursuant to Chapter 15 of

year. The state’s fiscal year begins on July 1, and ends on

Title 43 at the time of donation.

June 30 of the following year.

For 2014, each educational scholarship or tuition grant is

The tax credit is available only to corporate taxpayers. A

limited to the cost of tuition for a qualified student to attend the

partnership may pass this credit through only to its corporate

qualified school or 90% of the amount of state aid that

partners, each of which may claim a pro rata share of the

otherwise would be computed for the student as provided in

credit based on ownership interest. An S corporation may

Title 15, Chapter 9, Article 5, whichever is less.

claim this credit against income Arizona is taxing at the

corporate level, or the S corporation may elect to pass this

Specific Instructions

credit through to only its exempt organization shareholders,

each of which may claim a pro rata share of the credit based

Complete the name and employer identification number

on ownership interest.

section at the top of the form. Indicate the period covered by

The credit is available to an exempt organization that is

the taxable year. Include the completed form with the tax

subject to corporate income tax on unrelated business

return.

taxable income (UBTI). The credit must result from the

All returns, statements, and other documents filed with the

activities that generate UBTI.

department require a taxpayer identification number (TIN).

Co-owners of a business, including corporate partners of a

The TIN for a corporation, an exempt organization with

partnership or exempt organization shareholders of an

UBTI, an S corporation, or a partnership is the taxpayer's

S corporation, may each claim only the pro rata share of the

employer identification number. Taxpayers that fail to

credit allowed based on the ownership interest. The pro rata

include their TIN may be subject to a penalty.

share that would be distributed to non-eligible partners or

Part 1 - Current Taxable Year’s Credit

shareholders is lost. The total of the credits allowed all such

owners may not exceed the amount that would have been

Calculation

allowed for a sole owner of the business.

List each school tuition organization’s name, address, credit

If the allowable tax credit exceeds the taxes otherwise due,

approval number, and approved contribution amount. If you

or if there are no taxes due, the amount of the credit not used

made contributions to more than ten organizations, complete

to offset taxes may be carried forward for not more than five

and attach additional schedules.

consecutive taxable years as a credit against subsequent

years' income tax liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2