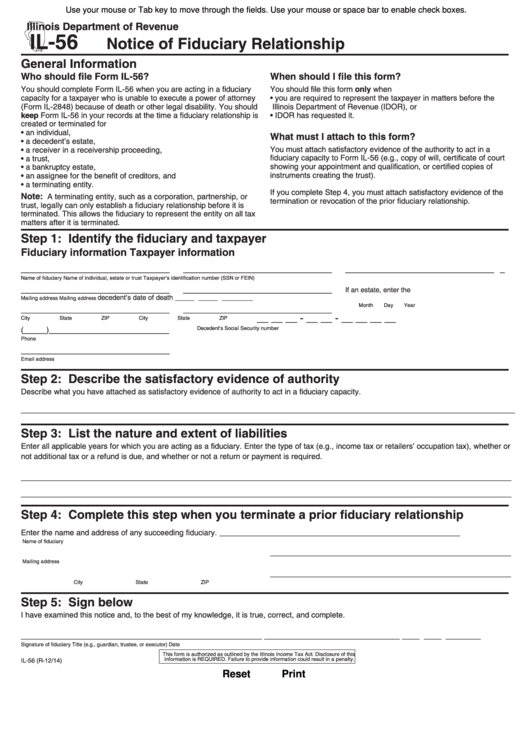

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-56

Notice of Fiduciary Relationship

General Information

Who should file Form IL-56?

When should I file this form?

You should file this form only when

You should complete Form IL-56 when you are acting in a fiduciary

capacity for a taxpayer who is unable to execute a power of attorney

•

you are required to represent the taxpayer in matters before the

(Form IL-2848) because of death or other legal disability. You should

Illinois Department of Revenue (IDOR), or

keep Form IL-56 in your records at the time a fiduciary relationship is

•

IDOR has requested it.

created or terminated for

•

an individual,

What must I attach to this form?

•

a decedent’s estate,

You must attach satisfactory evidence of the authority to act in a

•

a receiver in a receivership proceeding,

fiduciary capacity to Form IL-56 (e.g., copy of will, certificate of court

•

a trust,

showing your appointment and qualification, or certified copies of

•

a bankruptcy estate,

instruments creating the trust).

•

an assignee for the benefit of creditors, and

•

a terminating entity.

If you complete Step 4, you must attach satisfactory evidence of the

Note:

A terminating entity, such as a corporation, partnership, or

termination or revocation of the prior fiduciary relationship.

trust, legally can only establish a fiduciary relationship before it is

terminated. This allows the fiduciary to represent the entity on all tax

matters after it is terminated.

Step 1: Identify the fiduciary and taxpayer

Fiduciary information

Taxpayer information

__________________________

__________________________

___________________________

Name of fiduciary

Name of individual, estate or trust

Taxpayer’s identification number (SSN or FEIN)

__________________________

__________________________

If an estate, enter the

decedent’s date of death _____ _____ ________

Mailing address

Mailing address

__________________________

__________________________

Month

Day

Year

__ __ __ - __ __ - __ __ __ __

City

State

ZIP

City

State

ZIP

____

_____________________

Decedent’s Social Security number

(

)

Phone

__________________________

Email address

Step 2: Describe the satisfactory evidence of authority

Describe what you have attached as satisfactory evidence of authority to act in a fiduciary capacity.

_________________________________________________________________________________________________________________

Step 3: List the nature and extent of liabilities

Enter all applicable years for which you are acting as a fiduciary. Enter the type of tax (e.g., income tax or retailers’ occupation tax), whether or

not additional tax or a refund is due, and whether or not a return or payment is required.

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

Step 4: Complete this step when you terminate a prior fiduciary relationship

Enter the name and address of any succeeding fiduciary.

_______________________________________________________

Name of fiduciary

_______________________________________________________

Mailing address

_______________________________________________________

City

State

ZIP

Step 5: Sign below

I have examined this notice and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

_______________________________

____ ____ ________

Signature of fiduciary

Title (e.g., guardian, trustee, or executor)

Date

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

IL-56 (R-12/14)

Reset

Print

1

1